Take a look at our newest merchandise

“The extra issues change, the extra they keep the identical” goes the previous adage and it’s actually true within the curler coaster world of horology over time and many years.

Again in 2015, when the world experiencing (yet one more) monetary disaster, Gary Getz wrote this text with ideas on how to deal with a downturn.

This was the world again then, look acquainted? From Wikipedia:

“The 2015–2016 inventory market selloff was the interval of decline within the worth of inventory costs globally that occurred between June 2015 to June 2016. It included the 2015–2016 Chinese language inventory market turbulence, wherein the SSE Composite Index fell 43% in simply over two months between June 2015 and August 2015, which culminated within the devaluation of the yuan.

Buyers offered shares globally because of slowing development within the GDP of China, a fall in petroleum costs, the Greek debt default in June 2015, the consequences of the top of quantitative easing in the US in October 2014, a pointy rise in bond yields in early 2016, and eventually, in June 2016, the 2016 United Kingdom European Union membership referendum, wherein Brexit was voted upon.

“By July 2016, the Dow Jones Industrial Common (DJIA) recovered and achieved document highs. The FTSE 100 Index didn’t achieve this till later in 2016.”

Whereas the public sale costs cited under is perhaps outdated, Gary ideas on methods to take care of a market slowdown as a collector ring as true right now as they did 10 years in the past. The extra issues change, the extra they keep the identical. [Ed]

———————————-

“When one boy amongst a dozen throws a stone into the air, crying out, that ‘what goes up should come down,’ it is vitally possible so to occur.” – Theodore Sedgwick’s Hints to my Countrymen, 1826

As Mother all the time mentioned, “Timeliness is a advantage!”

After I first thought-about an article on this subject a while in the past in late 2015, the title was going to be “How Excessive is Up?” This was in reference to what, on the time, was the continued escalation within the costs of each new and used watches and the flood of higher-end, extremely difficult timepieces from makers each giant and small.

A thought for turbulent occasions

Now, it appears pretty evident that we’re on the down slope of both a cyclical correction in costs or, if one takes a much less optimistic view, a everlasting lack of watch worth because the mechanical timepiece trade faces quite a lot of challenges and potential disruptions.

So what’s a collector to do? And what classes can we draw, each from current watch public sale outcomes and the historical past of different luxurious classes, to information us?

What we’re seeing now (late 2015)

After a protracted interval of ascendancy, the marketplace for pre-owned items in the newest cycle of auctions confirmed some fairly clear indicators of softening. I went by way of the newest Geneva, Hong Kong, and New York auctions on a lot-by-lot foundation and located a number of patterns.

Choose prime items are nonetheless sturdy: On the very prime of the heap, there are clearly collectors who need what they need and who pays prime greenback for very particular watches in nice situation. These needn’t essentially be the standard suspects (Patek Philippe and Rolex); at Phillips’ Hong Kong public sale, a classic Cartier Crash offered for US $141,000, greater than 5 occasions its excessive estimate.

Another cult items, just like the Patek Philippe Reference 5020R cushion-shaped perpetual calendar chronograph, offered properly above estimate as properly.

Patek Philippe Reference 5020R on the creator’s wrist at Christie’s public sale preview in Geneva

However even on the excessive finish, all will not be sweetness and light-weight. Christie’s New York catalog cowl piece, a hanging Patek Philippe pocket watch, didn’t promote, as an illustration. As did the Rolex Reference 6264 “John Participant Particular” Daytona in Hong Kong.

Throughout current auctions, different mouth-watering items akin to a Patek Philippe Reference 3939 tourbillon minute repeater and an Audemars Piguet Grande Complication offered at or under the midpoints of their projected ranges. And there have been some stunners, together with a Patek Philippe 5102G Celestial that some fortunate soul took residence for the (relative) cut price value of $175,000.

Stable performer: Patek Philippe Reference 3939 Tourbillon Minute Repeater

Variants matter: For example, three Greubel Forsey watches have been supplied at current auctions. The 2 24-second single tourbillons in white metals with white dials failed to succeed in their reserves, whereas a extra fascinating double tourbillon in rose gold with black dial offered inside its estimated vary.

The mid-market is coming again to earth: Each at public sale and in personal gross sales, as an illustration, plainly the first-generation A. Lange & Söhne Datograph in platinum, a basic piece if ever there have been one, is settling right into a buying and selling vary at or under $40,000, down 15 or 20 % from current tendencies.

Many have missed the vendor’s market: Throughout the current auctions, about 20 % of the watches didn’t promote. Amongst these have been giant numbers of completely fascinating watches like Panerais and Rolex Day-Dates for which provide merely exceeded demand, a minimum of on the costs being requested.

Classes from the (automotive) previous

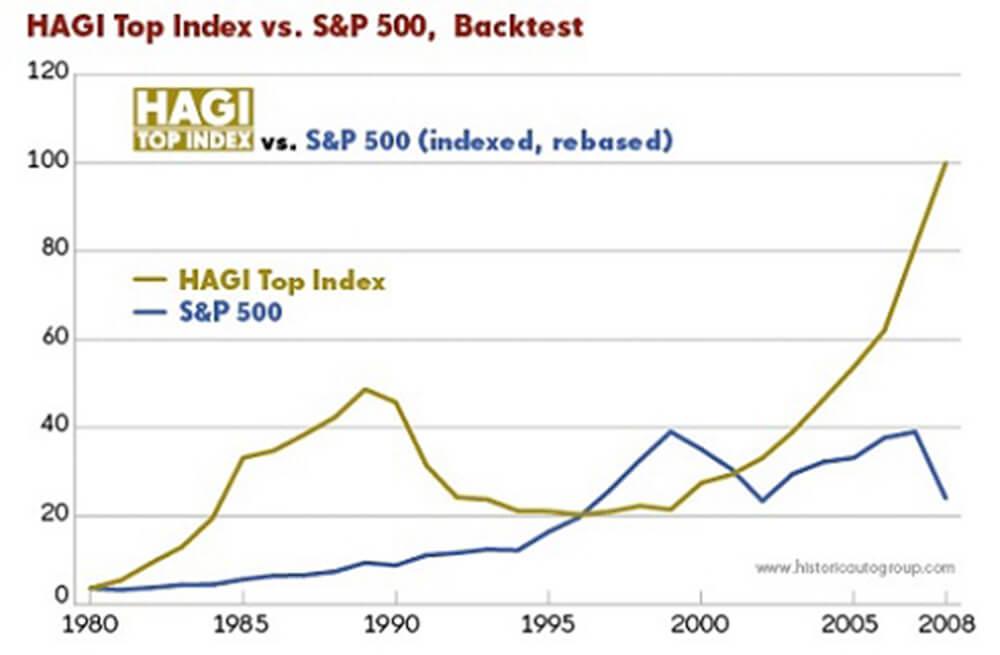

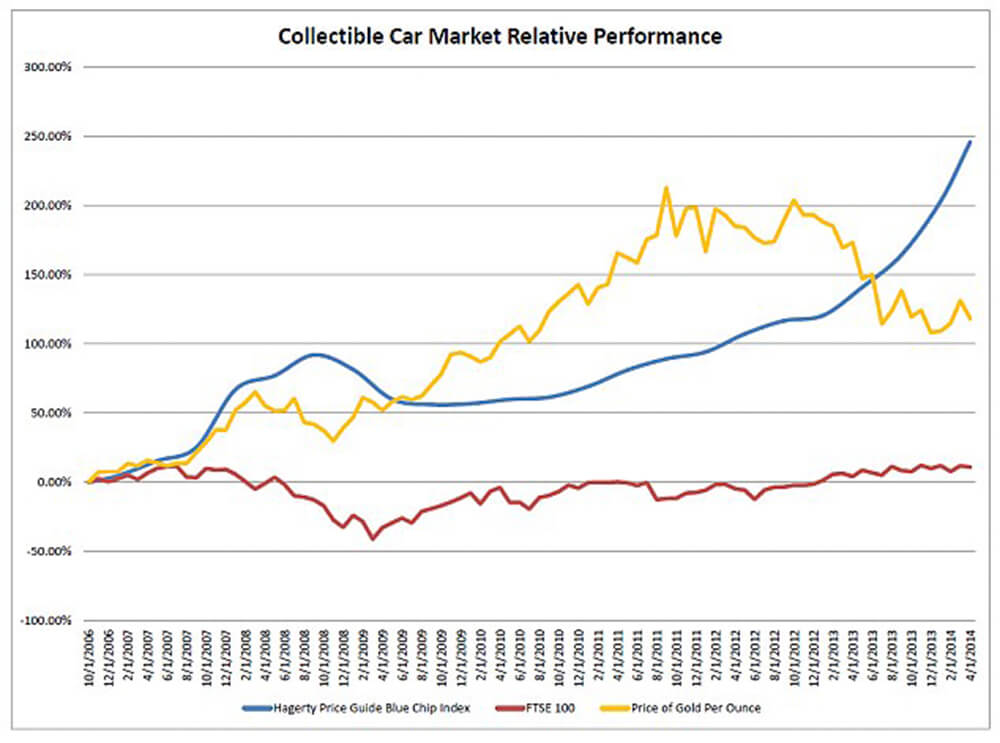

In fact, comparatively giant swings in collectible luxurious items values usually are not unprecedented. Check out the 2 shows on the collector automobile market under. The primary reveals the habits of a weighted index from 1980 by way of 2008, and the second picks up in 2006 and runs by way of 2014.

Collector automobile worth index, 1980-2008 (picture courtesy www.historicautogroup.com)

What we see is that in opposition to a long-term backdrop, essentially the most collectible autos have carried out very properly certainly in monetary phrases, however with some very substantial downswings throughout the financial crises of the late-Nineteen Eighties and early Nineties and once more after 2008.

Collector automobile worth index, 2006-2014 (picture courtesy www.hagerty.com)

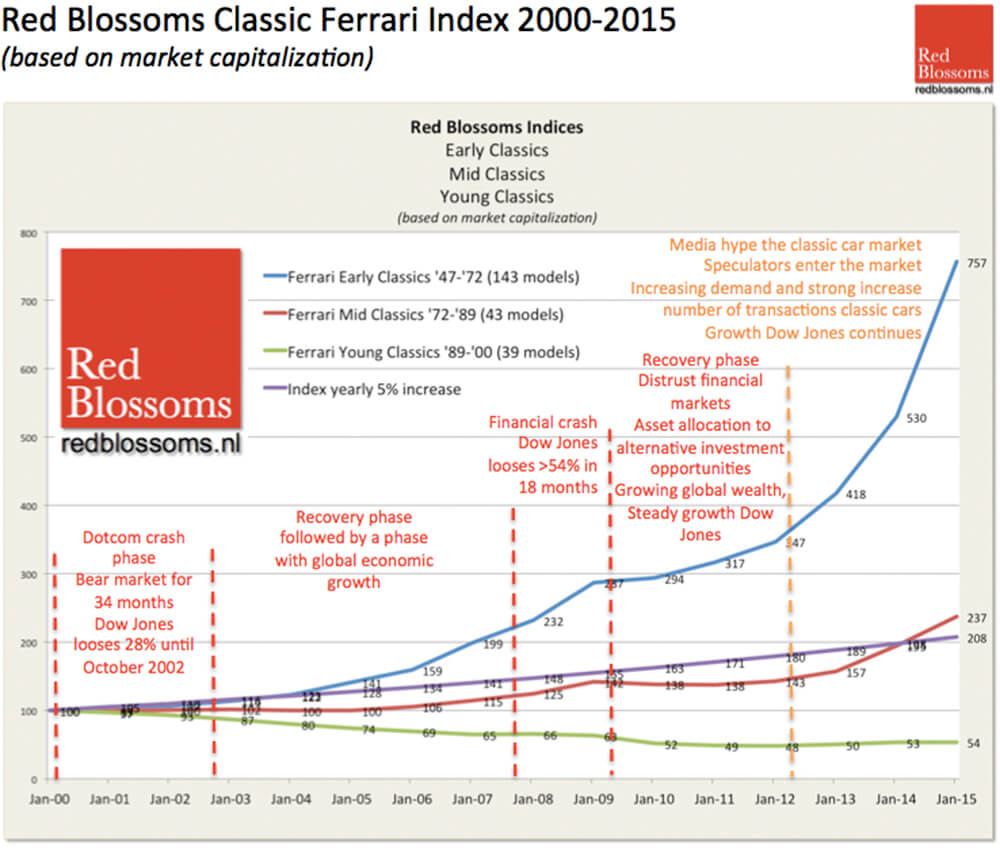

And as we’re seeing within the watch market, even inside a model like Ferrari not all fashions are equal. A fast peek on the graph under reveals that whereas values of essentially the most fascinating older Ferraris have gone exponential, so-called younger classics have been on a chronic depreciation trajectory, with just a few shining exceptions just like the Miami Vice-era Testarossa that now appears to be having fun with a renaissance.

Specifics matter: Ferrari values, 2000-2015 (picture courtesy www.redblossoms.nl)

Sufficient about classic; what about new watches?

Over the previous a number of years, it’s been onerous to maintain up with the tempo of the watch trade’s introductions of extremely difficult – and extremely costly – watches. Single, double, triple, and quadruple tourbillons; chiming watches; automata; novel techniques for growing accuracy; you title it.

Going upmarket: the creator’s Vianney Halter Deep Area Tourbillon

On the identical time, we’ve seen the value factors on watches in any respect tiers going up; $10,000 appears to be the brand new $4,000; $30,000 the brand new $10,000; $100,000 the brand new $30,000; and $400,000 the brand new $100,000.

Harvard professor Clayton Christenson famously described what occurs when a “disruptive expertise” arriving from exterior of a conventional trade begins to threaten the established order: the incumbents start emigrate upmarket, abandoning lower-margin territory to the newcomers and bettering their merchandise’ performance till it considerably overshoots the necessities of the mainstream market.

Sound acquainted?

Confronted with disruption from exterior and under in addition to softening markets in Asia and elsewhere, the watch trade is right now at vital danger.

So: what to do as a collector?

Right here’s the primary query to ask your self: are you a collector or an investor? If the reply is the latter, what follows is more likely to be of restricted use to you, although I want you luck.

For collectors, together with these like myself who nonetheless want to concentrate to the financial worth of their collections to maintain from “getting damage,” maybe just a few reminders of timeless adages and a few new wrinkles will assist.

Purchase what you like: On the finish of the day, that’s what this entire passion (not enterprise) is about, proper?

Purchase what you like: the creator’s Jaeger-LeCoultre Futurematic

Suppose portfolio: I’ve by no means been extra conscious of my pal Terry’s sage serious about sorts of watches in a single’s assortment as I’m right now. There are the “funding” items: not within the sense of investing for acquire, however core items with established market worth and timeless enchantment that type the middle of the plate.

Subsequent, “patronage” items: for these of us who help the independents, purchases that preserve small, modern gamers alive.

Lastly, “enjoyable” items: these indulgences, at any value level, that simply make us really feel good.

In a down market, some portfolio re-balancing is perhaps so as. On the margin, may that “funding” platinum A. Lange & Söhne Datograph be a greater buy than the “enjoyable” A. Lange & Söhne Zeitzone in pink gold with gray dial?

May funds that may go into a few “enjoyable” buys be saved up and used for a “patronage” purchase that’s a minimum of as fulfilling?

I’m not recommending the top of enjoyable or falling into the entice of constructing your assortment look similar to everybody else’s as a liquidity play, however in occasions like these a portfolio view can are available in fairly useful certainly.

Patronage meets funding: the creator’s Philippe Dufour Simplicity (photograph courtesy Philippe Dufour)

Keep in mind your mates: That is no time to overlook your pleasant approved sellers; negotiate onerous and anticipate good worth, however don’t go operating to the gray market simply to save lots of a couple of dollars.

Purchase low: Are different folks fleeing the market? For a collector, this can be a shopping for alternative! Suffice it to say that I’m scanning the upcoming auctions and present personal gross sales with nice curiosity.

Suppose strong worth: There are limits to how stodgy one ought to be in a passion, and I’m one of many worst violators of what I’m about to say. However as of late it might be salutary to go on one or two of these super-complicated watch buy alternatives in favor of meat-and-potatoes items.

On the identical time, have the braveness of your convictions: A Vianney Halter Antiqua did fairly properly at one of many current auctions, beating its excessive estimate by 25 %. I purchased low a number of years in the past and plan to carry for a few years to return. For those who see a watch as an everlasting basic, purchase now – and luxuriate in for the long run.

Braveness meets enjoyment: the creator’s Vianney Halter Antiqua

And what concerning the makers?

The brand new watches at present coming to market are the merchandise of years of prosperity and escalating expectations, so I’m not anticipating an trade about-face as quickly as SIHH and Baselworld 2016.

For the interval forward, I’ve just a few modest ideas for the makers.

Contest disruption: Keep away from the oh-so-tempting urge to maintain shifting upmarket till you’re thus far into the stratosphere that no clients stay. For the teams with multi-brand portfolios, remember to place a minimum of one marque as a preventing model in opposition to disruption. Right here, Jean-Claude Biver’s strikes with TAG Heuer and Jérôme Lambert’s efforts at Montblanc come to thoughts.

Innovate inside constraints: Unbounded innovation typically results in uninspiring outcomes. Our good friend William Massena famous in an interview on Hodinkee that the Swiss watch trade has been most artistic in occasions of hassle; now appears the time to demand brilliance inside tight confines of value and re-use of current elements.

Innovation inside constraints: the Laurent Ferrier Galet Sq.

Independents, stroll the tightrope: I want that I had higher recommendation to offer than that! For many unbiased watchmakers, the problem goes to be remaining true to an inventive imaginative and prescient whereas sustaining financial viability. The center floor could also be a extra intensive deal with gathering enter from the small group of “patronage” collectors and soliciting them for group purchases and “subscription” items, whereas on the identical time pushing onerous by way of social media and different promotional means to succeed in new teams of patrons.

Should each purchaser be an aficionado? Maybe not.

Parting Ideas

“The Chinese language use two brush strokes to jot down the phrase ‘disaster.’ One brush stroke stands for hazard; the opposite for alternative.” – John F. Kennedy, April 12, 1959

Because it seems, Kennedy was apparently mistaken: linguistic specialists recommend that the true mixture of meanings within the Chinese language expression is nearer to “hazard” assembly “essential second,” highlighting relatively than diminishing the sense of imminent peril.

What can we make of this?

Whereas the trade should contemplate whether or not present situations actually symbolize a risk to survival, for collectors maybe Kennedy’s mistaken interpretation could also be extra related, given the good number of fantastic watches, each new and classic, now we have obtainable to us.

So for now, preserve calm and proceed gathering!

* This text was first revealed on December 15, 2015 at Maintain Calm And Proceed Accumulating: Recommendation For An Up And Down Watch Market.

You may additionally take pleasure in:

False Shortage And Metal Sports activities Watches: A Collector’s View

Why Watchmaking Issues Now

Getting Via The Nice Lockdown Of 2020: A Collector’s Information To Solitude

3 Pack Screen Protector Film, compatible with Rado R12.413.803 TPU Guard for Smart watch Smartwatch ( Not Tempered Glass Protectors )