Try our newest merchandise

From the Morgan Stanley-WatchCharts State of the Secondary Watch Market Report for the first Quarter 2025.

Morgan Stanley want to thank WatchCharts for his or her contribution of secondary watch value information to our evaluation on this report. WatchCharts is a analysis platform for pre-owned watches, and never a part of Morgan Stanley’s Analysis Division.

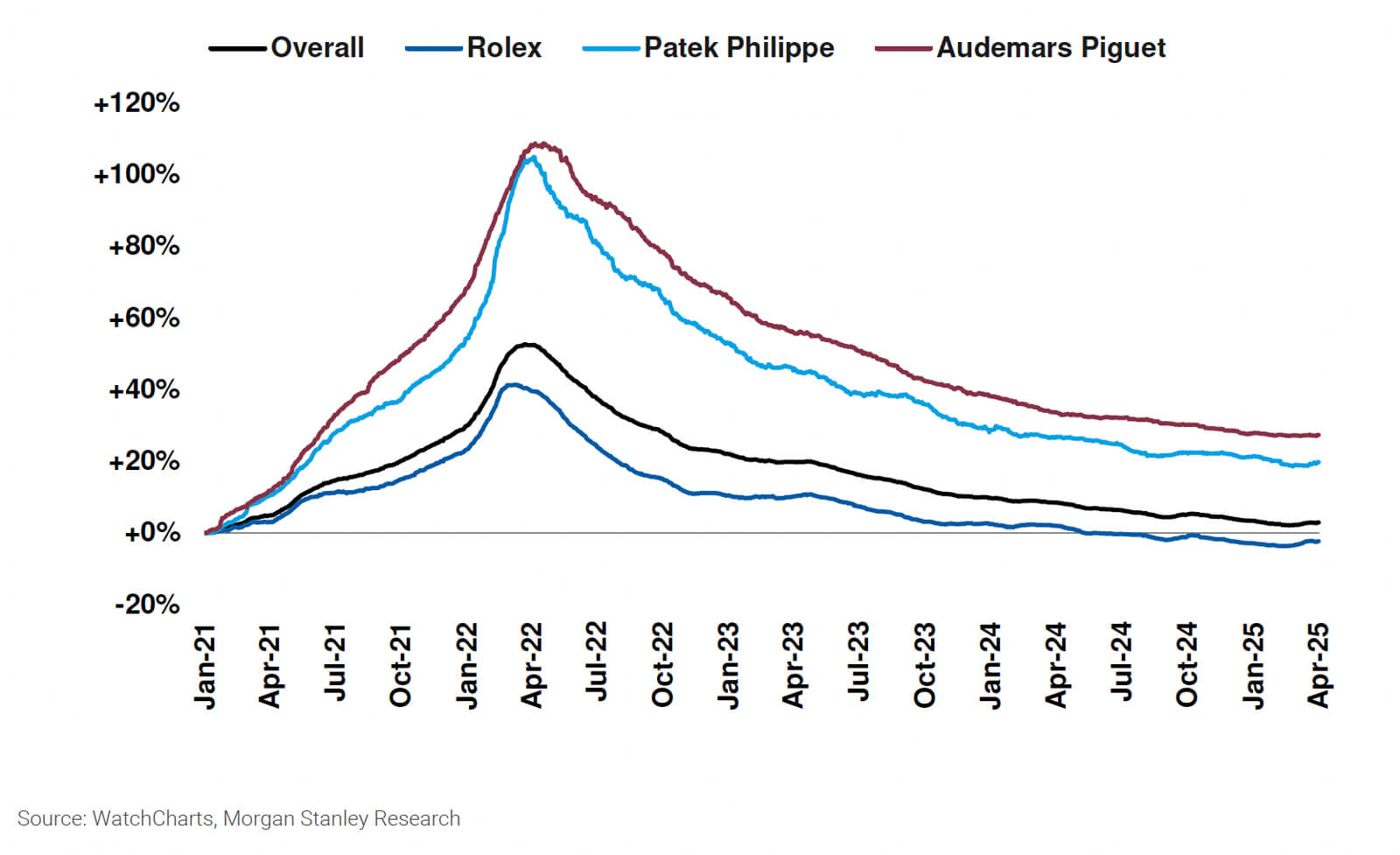

Funding implications. General, costs of watches on the secondary market have continued to lower in 1Q (for the twelfth quarter in a row), albeit on the lowest charge since 2Q22, with personal gamers performing higher than the listed names: 1Q25 costs are down -0.4% QoQ (vs. -1.6% in 4Q24).

As a gaggle, LVMH was the worst performer in 1Q25, with costs down -3.2% QoQ / -8.5% YoY. The higher relative efficiency from Zenith and Bulgari was offset by poorer traits from TAG Heuer and Hublot. Cartier (-1.1% QoQ) fared higher than the opposite Richemont manufacturers, bettering from 4Q24 and sustaining its resilient place amongst mid-level manufacturers.

Swatch Group’s efficiency was largely depending on the outperformance of Omega inside its portfolio (-1.0% QoQ), whereas many different manufacturers carried out poorly. Trying forward, with volatility round tariffs (see observe right here) and a weak begin to the yr, with exports down -2.4% within the first two months in 2025 (see our observe right here), we anticipate the first market gross sales to contract additional – not less than -HSD within the yr (decline was -2.8% in 2024), with the three listed teams (LVMH, Richemont, and Swatch) seemingly persevering with to underperform the market (see additionally our takes from Watches & Wonders right here).

What’s new? We break down the most recent traits within the secondary watch market in 1Q25 on this observe, utilizing information from secondary watch market analysis platform WatchCharts. Monitoring the worth evolution of secondhand watches is fascinating for fairness buyers, as basically, it offers a great barometer of a model’s desirability and thus future pricing energy/development trajectory.

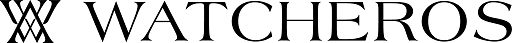

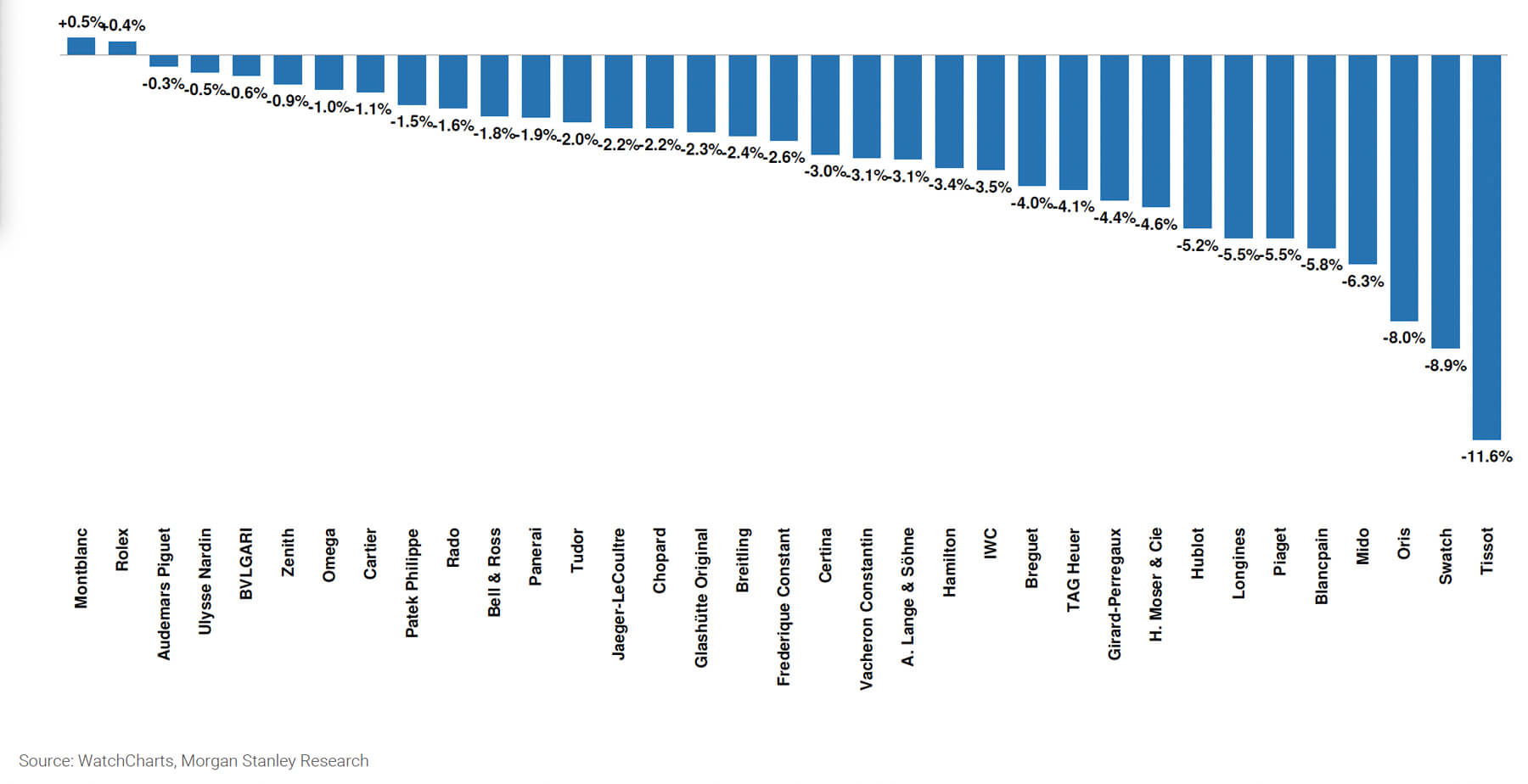

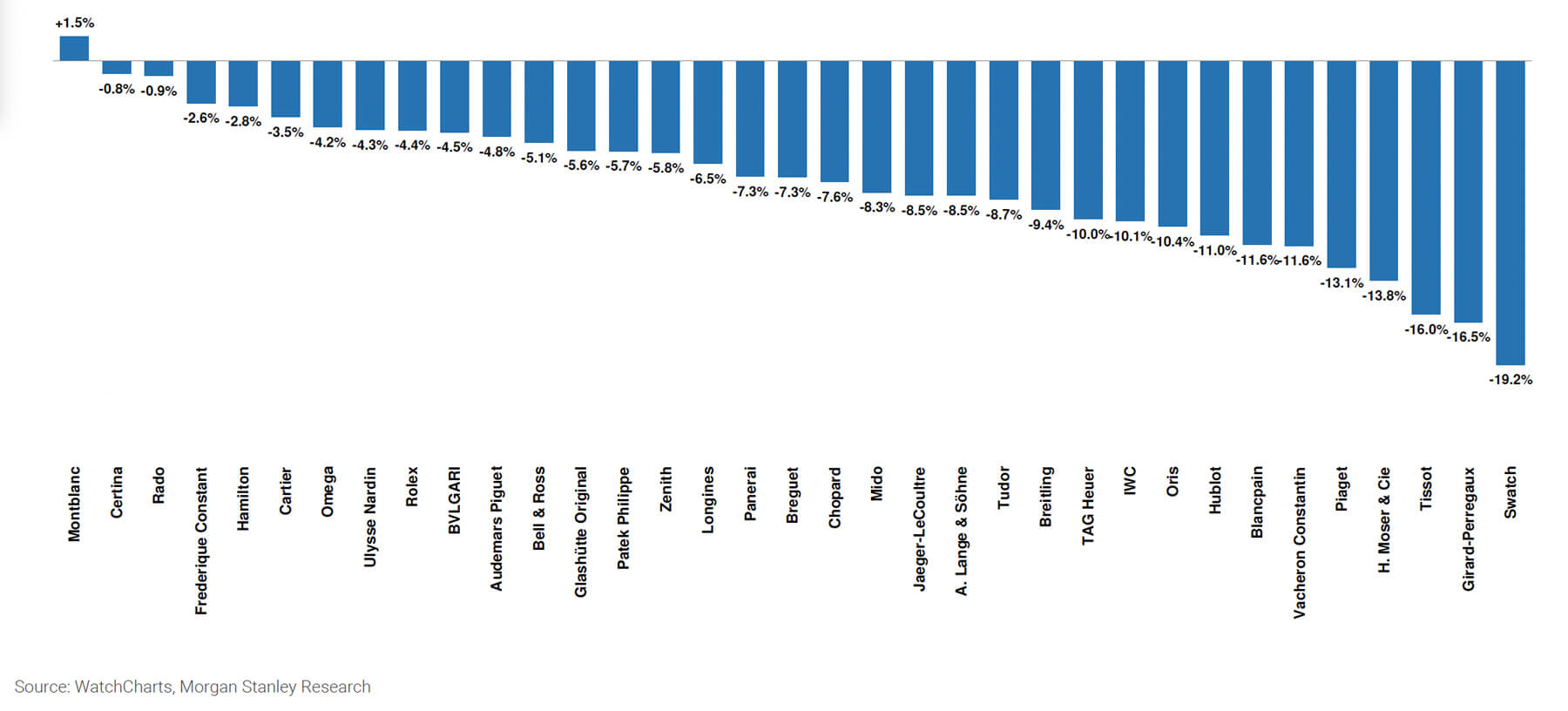

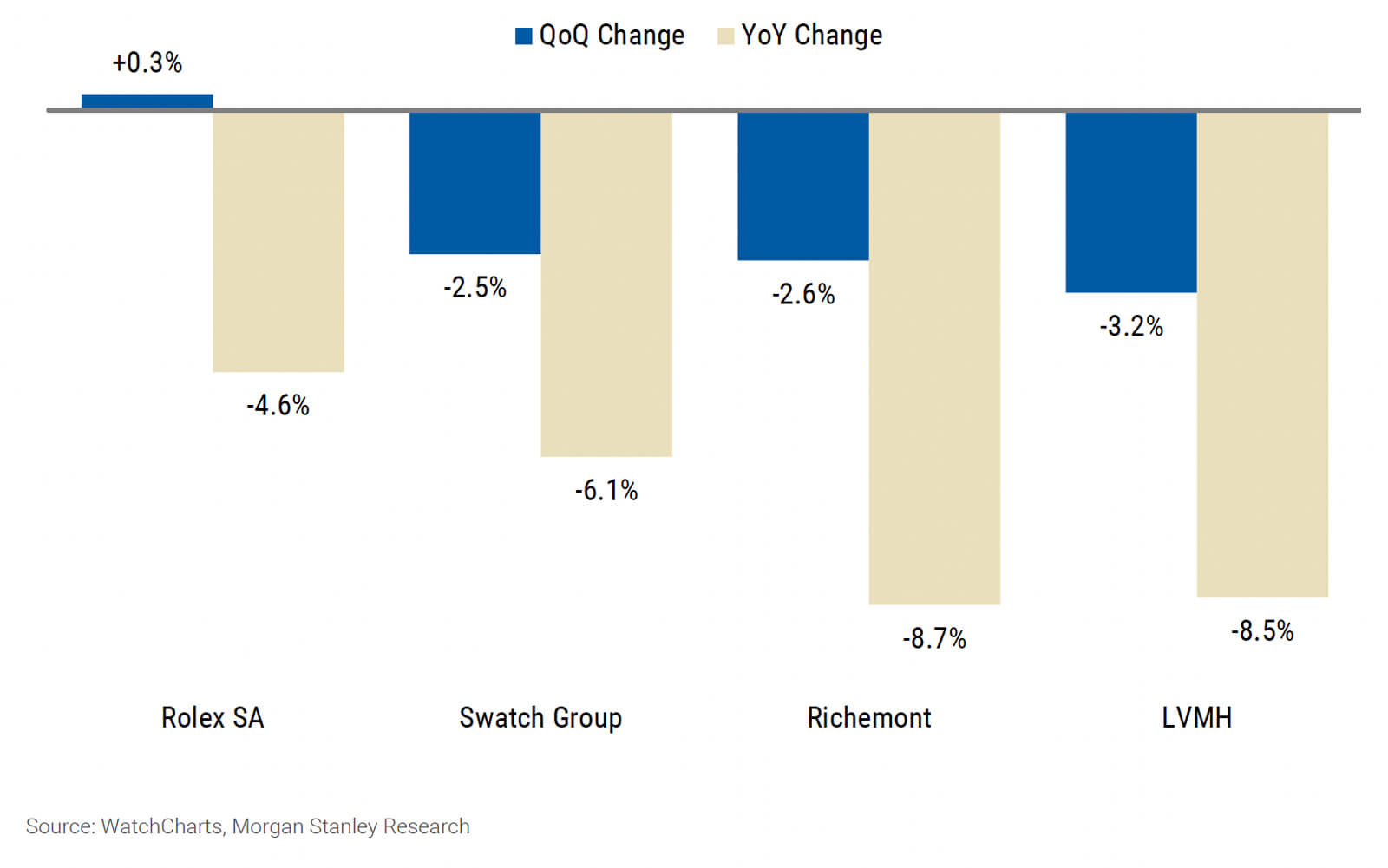

QoQ and YoY development of WatchCharts value tracker for Swiss teams in 1Q25

What the info says:

Secondary costs continued to fall in Q1, although the WatchCharts General Market value tracker fell solely -0.4% QoQ in 1Q25, representing the bottom quarterly charge of decline since 2Q22 (marking 12 consecutive quarters of declining costs).

Nonetheless, we observe that this efficiency is now formed extra by the Large Three (Rolex, Patek Philippe, and Audemars Piguet), which have been among the many strongest manufacturers within the quarter, whereas the listed gamers underperformed. Nonetheless, among the many 35 Swiss watch manufacturers we monitor, solely two (Rolex and Montblanc) noticed a constructive QoQ efficiency.

Non-public gamers proceed to outperform, whereas the listed names battle… Rolex (+0.4% QoQ), Audemars Piguet (-0.3% QoQ), and Patek Philippe (-1.5% QoQ) have been among the many greatest performing manufacturers in 1Q25 (ranked #2, #3, #9 respectively) in secondary watch costs.

This development has inflected from 2024, when collectively they positioned extra in the course of the pack (and much more so from 2023, when the Large 3 have been actually main the decline), and is extra reflective of traits within the major market, the place they proceed to take market share (see our eighth annual Swiss Watcher right here).

…except Cartier (which we estimated accounted for ~45% of Richemont’s major watch gross sales in FY24), which fared higher, rating above Patek Philippe in #8 place, seeing costs drop QoQ by solely -1.1%, rebounding from -2.2% in 4Q24. This relative outperformance is once more reflective of the model’s efficiency within the major market – we estimate Cartier expanded its market share by +65 bps in 2024 to eight%, solidifying its no. 2 rating.

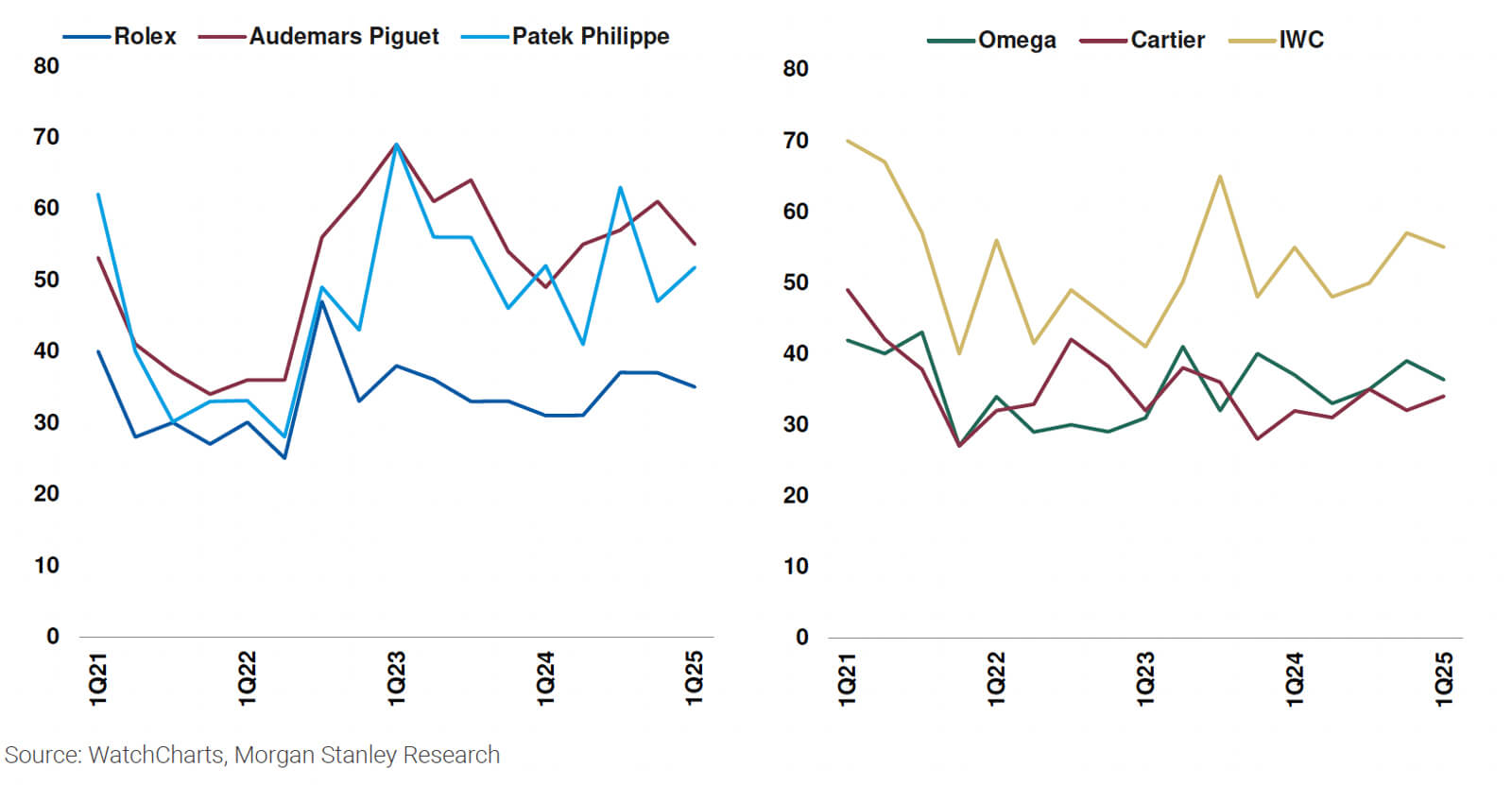

Nonetheless, demand for watches on the secondary market stays for a lot of manufacturers. Regardless of falling secondary costs, provide has risen, while the speed of stock turnover has remained constant (as is the case for the likes of Cartier, Omega, and IWC, to call just a few).

Trying forward: 1. Flight to high quality throughout unstable instances might end in shoppers selecting the ‘safer’ investments, favouring manufacturers akin to Rolex, Cartier, Audemars Piguet, and Patek Philippe, that are extra like to carry their worth (to the detriment of the listed gamers).

However on the similar time, 2. as consciousness round residual worth grows, mid-size gamers (akin to A Langes & Sohne and IWC, and many others.) that resell at reductions of -30% to -40% to the retail market might have the potential to carry out higher on the secondary market. As shoppers are more and more educated across the value differentials, they could want the secondary channel, to the detriment of the first market – we observe that whereas among the manufacturers could be down -DD within the major market, gross sales within the secondary market are up +SD in some instances.

Efficiency by group:

- LVMH (-) noticed the most important sequential drop in Q1 as costs general fell -3.2percentQoQ, however efficiency assorted by model. Whereas Bulgari (-0.6% QoQ), seemingly benefitting from the yr of the Snake, and Zenith (-0.9% QoQ ) costs fell lower than -1% QoQ, TAG Heuer (-4.1% QoQ) and Hublot (-5.2% QoQ), with most fashions retailing at a excessive value level of the low-five-figures, carried out worse. LVMH will report 1Q25 outcomes on Monday April 14th submit shut (VA cons. presently anticipating the Watches & Jewelry division up +2.1% yoy at cons. FX, sequentially down from+3% in This autumn).

- Richemont (=) manufacturers proceed to steadily decline as the costs of its watch manufacturers (except for Cartier) fell -LSD QoQ, with the likes of Vacheron Constantin down -3.1% QoQ, Jaeger LeCoultre down -2.2% QoQ, and IWC down -3.5% QoQ. Richemont will report 4Q/FY25 outcomes on Friday Might sixteenth. We presently anticipate the Specialist Watchmakers division to submit a CER decline of -6% within the quarter ending March (see our preview right here), and we see the consensus determine for the fiscal yr March-26 of +4% as too excessive (MSe -1%, with additional potential for draw back danger).

- Swatch Group (-) noticed costs decline -2.5% QoQ in 1Q25 with prime model Omega (we estimate made up ~75% of the group’s earnings in 2024) costs declining ‘solely’ -1% QoQ and failing to offset the poorer efficiency of different manufacturers. Swatch and Tissot have been notably the two poorest performing manufacturers within the quarter, with costs declining -8.9% QoQ and -11.6% QoQ respectively. The Swatch Group is predicted to report 1H25 outcomes on the finish of July (MSe presently forecasting a topline contraction of -5% CER, beneath css of +1%).

What’s new in 1Q25

Beneath we offer among the key traits for the secondary watch market in 1Q25.

Secondary costs fell -0.4% in 1Q25, representing the bottom quarterly charge of decline since 2Q22 (marking 12 consecutive quarters of declining costs). Nonetheless, we observe that whereas this represents the bottom quarterly charge of decline 2Q22, efficiency is now closely biased in the direction of the Large Three (Rolex, Patek Philippe, and Audemars Piguet), which have been among the many strongest manufacturers within the quarter whereas the listed gamers underperformed. Moreover, among the many 35 Swiss watch manufacturers we monitor, solely two (Rolex and Montblanc) noticed a constructive QoQ efficiency.

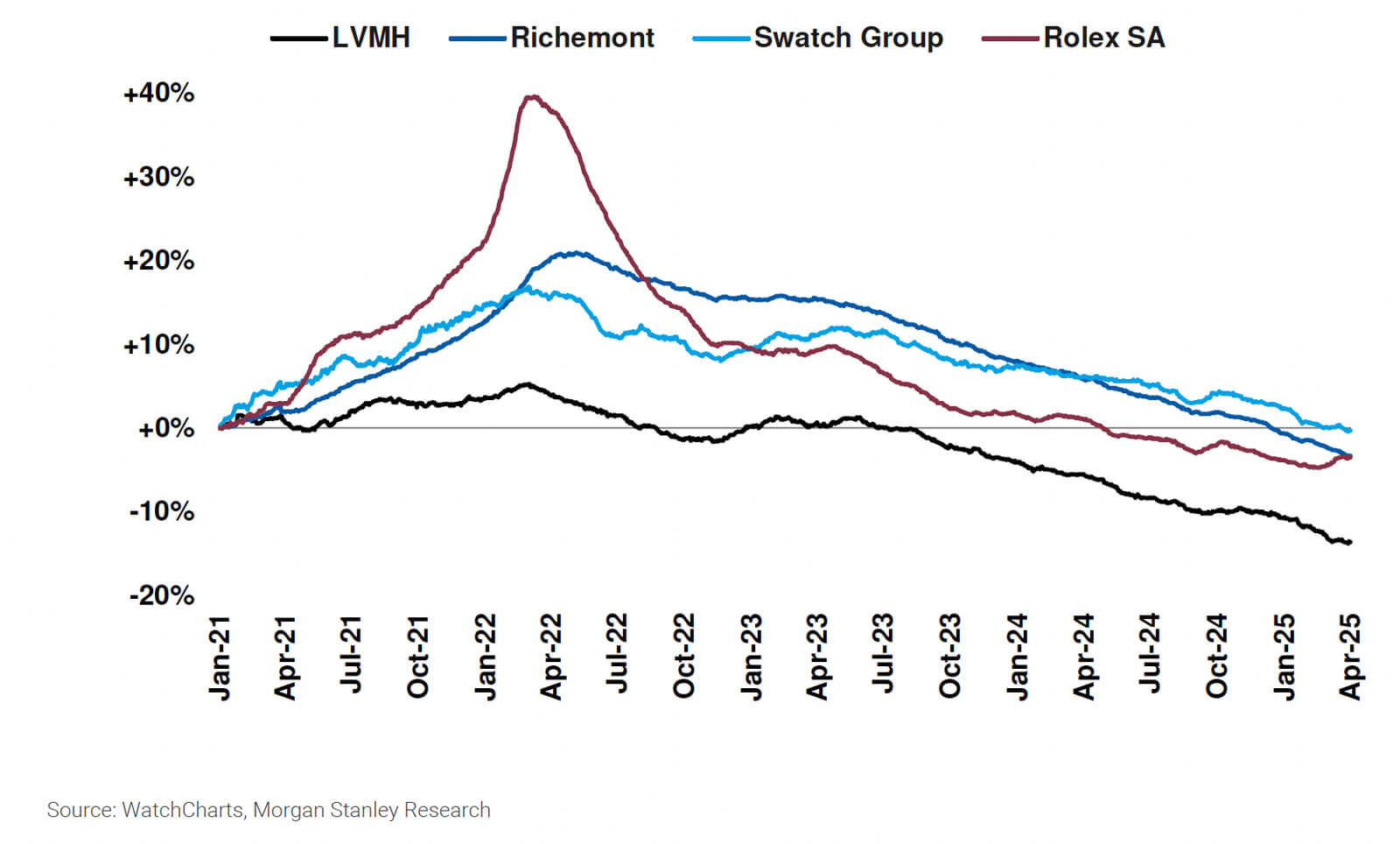

Non-public gamers proceed to outperform whereas the listed names battle general… Among the many 4 main Swiss watch gamers, Rolex SA costs rose +0.3% QoQ, whereas Swatch Group, Richemont, and LVMH all fell round -3%. QoQ (see Exhibit 1 ). The highest 10 manufacturers included Rolex (+0.4% QoQ), the second greatest performing model within the quarter, Omega (-1.0% QoQ), #7 and Cartier (-1.1% QoQ).

Nonetheless, most different manufacturers from the listed teams struggled. Vacheron Constantin (-3.1%), A. Lange & Sohne (-3.1%), and IWC (-3.5%) from Richemont all misplaced greater than 3%, whereas TAG Heuer (-4.1%) and Hublot (-5.2%) from LVMH fared even worse.

General secondary demand stays resilient, however pricing energy of the listed teams could also be eroding. We noticed an enchancment in market well being indicators for the Large Three, with a correction in Rolex provide ranges being significantly encouraging. Among the many key manufacturers from listed teams, secondary demand stays usually robust regardless of falling costs.

We imagine that a few of this demand could also be coming on the expense of retail gross sales, significantly when taking into consideration rising secondary market reductions and vital YoY declines in retail gross sales for a lot of manufacturers (primarily based on FY24 LuxeConsult, the main Swiss watch consulting agency, estimates – see our observe right here).

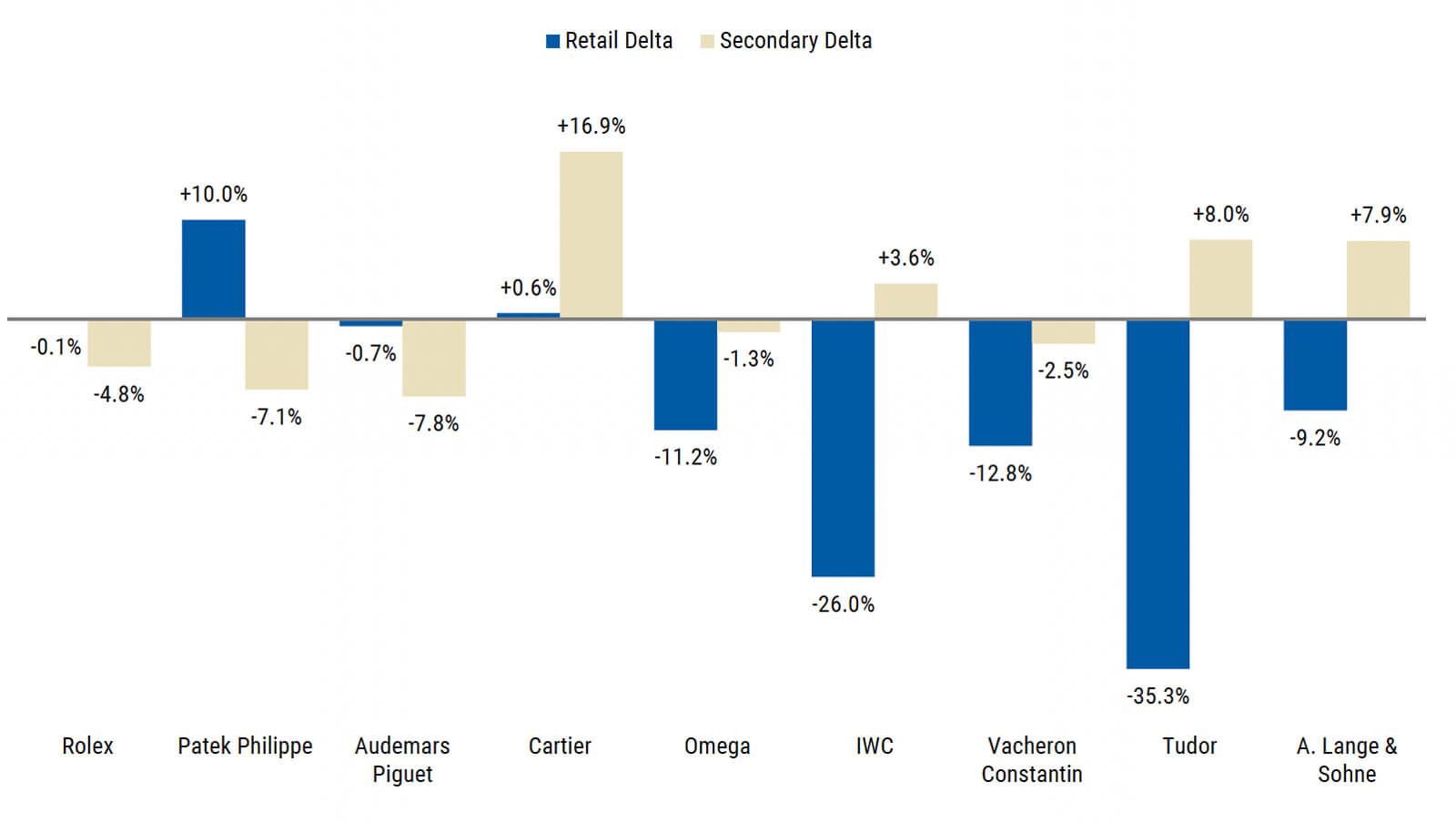

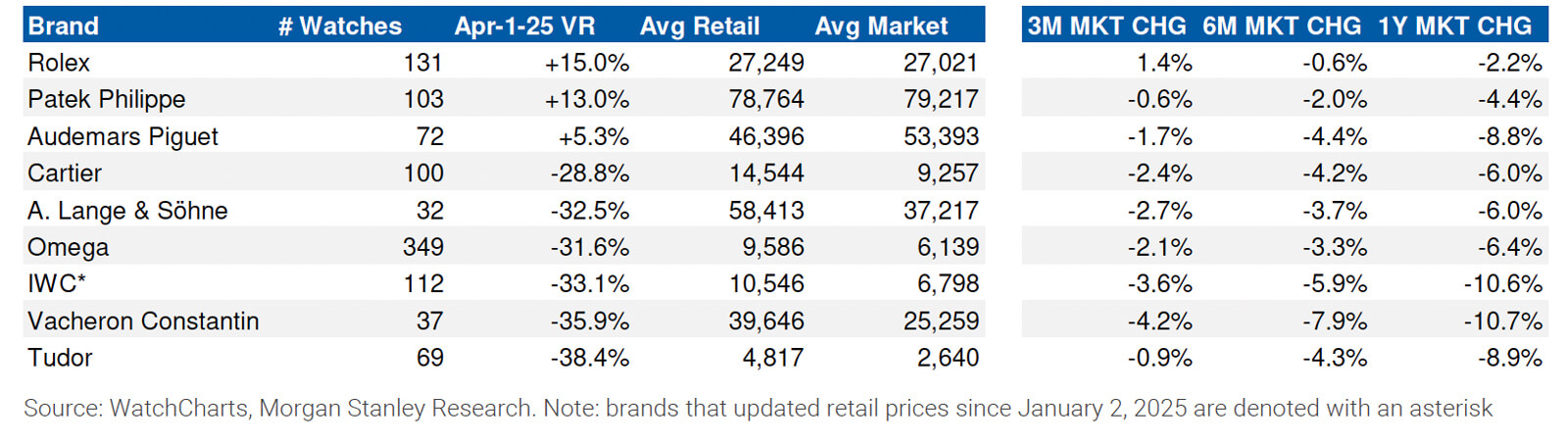

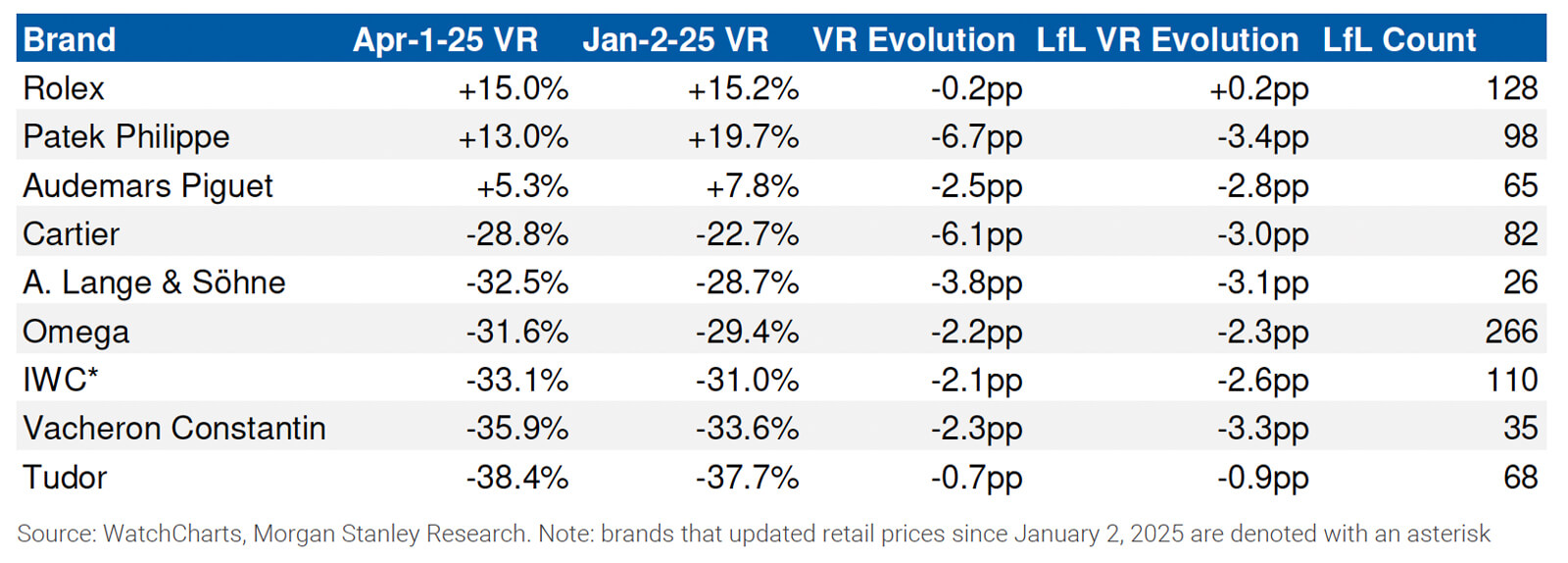

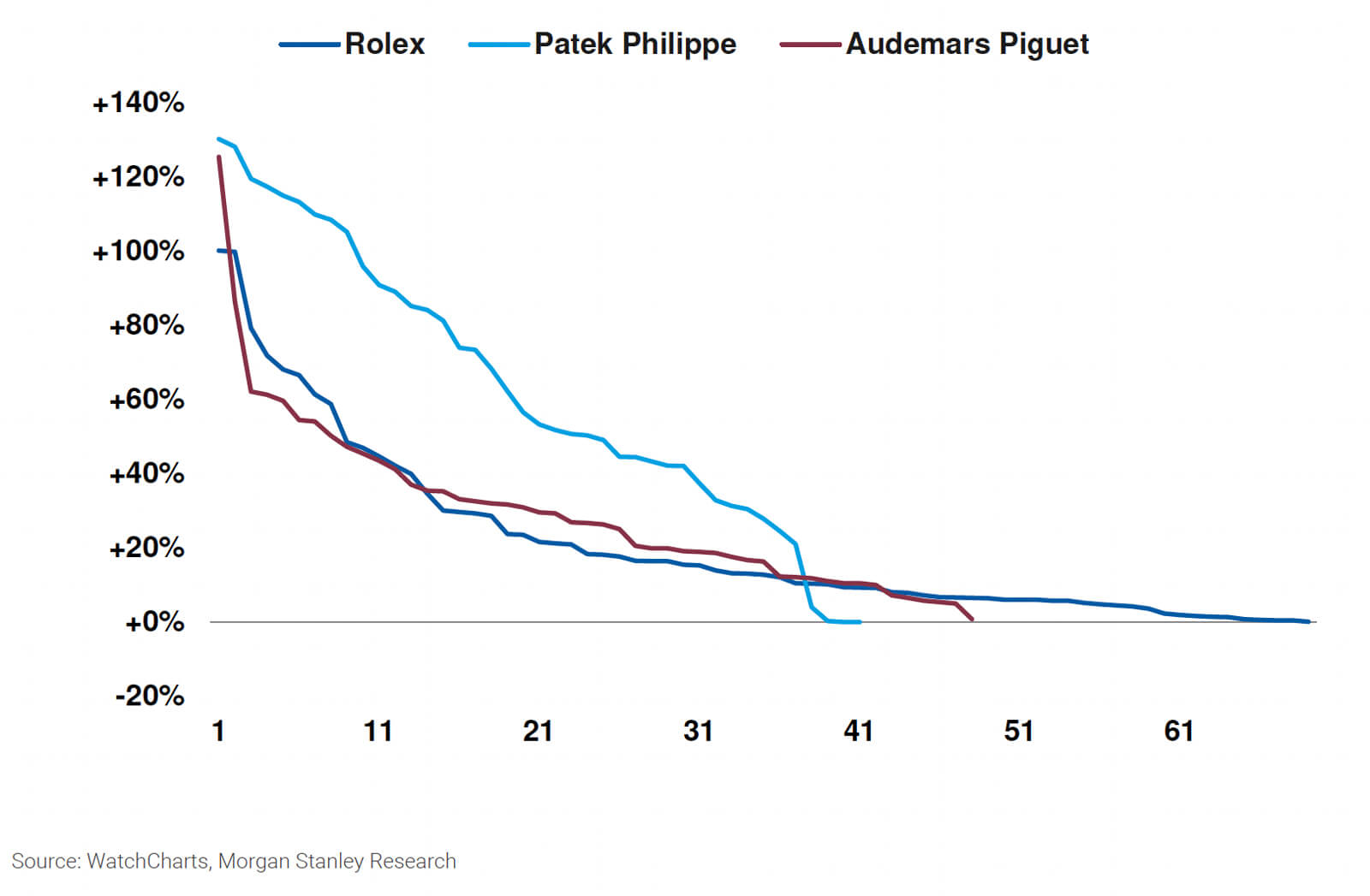

Worth retention worsened for all manufacturers aside from Rolex, whereas IWC rolled out extra retail value decreases. Rolex’s worth retention improved by +0.2pp on a like-for-like (LfL) foundation, although it was down -0.2pp throughout all in-production fashions. The model has additionally changed Patek Philippe as the highest performer by worth retention amongst these we monitor.

The Large Three proceed to commerce above retail, whereas each different model has a median secondary market low cost of not less than -28%. After decreasing retail costs by a median of three% in 4Q24, IWC continued to roll out extra retail value adjustments in 1Q25, with retail costs lowering by an extra 1% on common.

The Rolex CPO program, which had a trajectory of regular development all through 2024, has stalled in 1Q25. World CPO stock ranges and CPO premiums remained comparatively constant QoQ, with 1Q25 gross sales reaching the $100 million mark by our estimate. Nearly all of CPO stock continues to be held by just a few key retailers, with greater than half of all stock coming from Rolex (via Bucherer and Tourneau) and Watches of Switzerland.

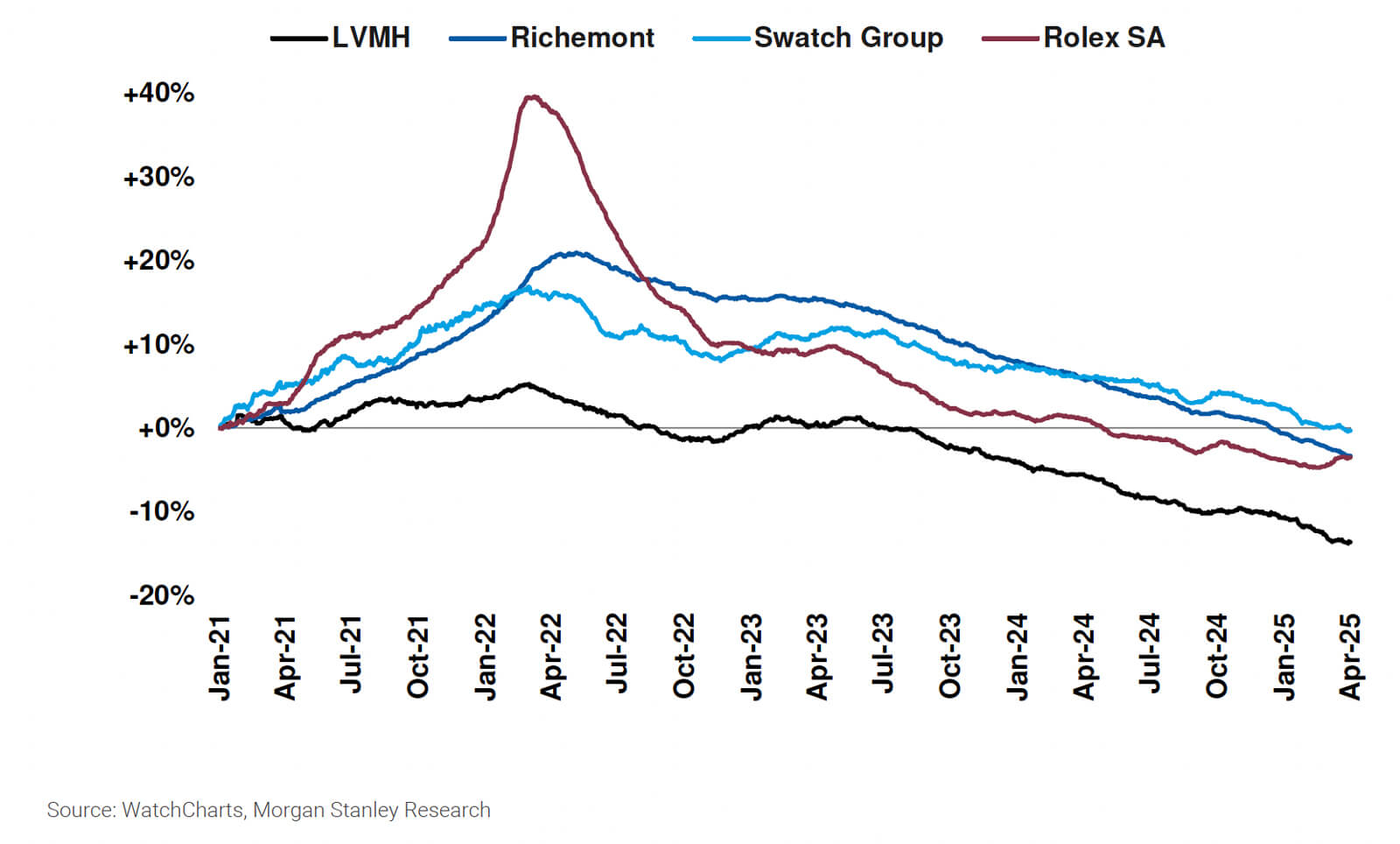

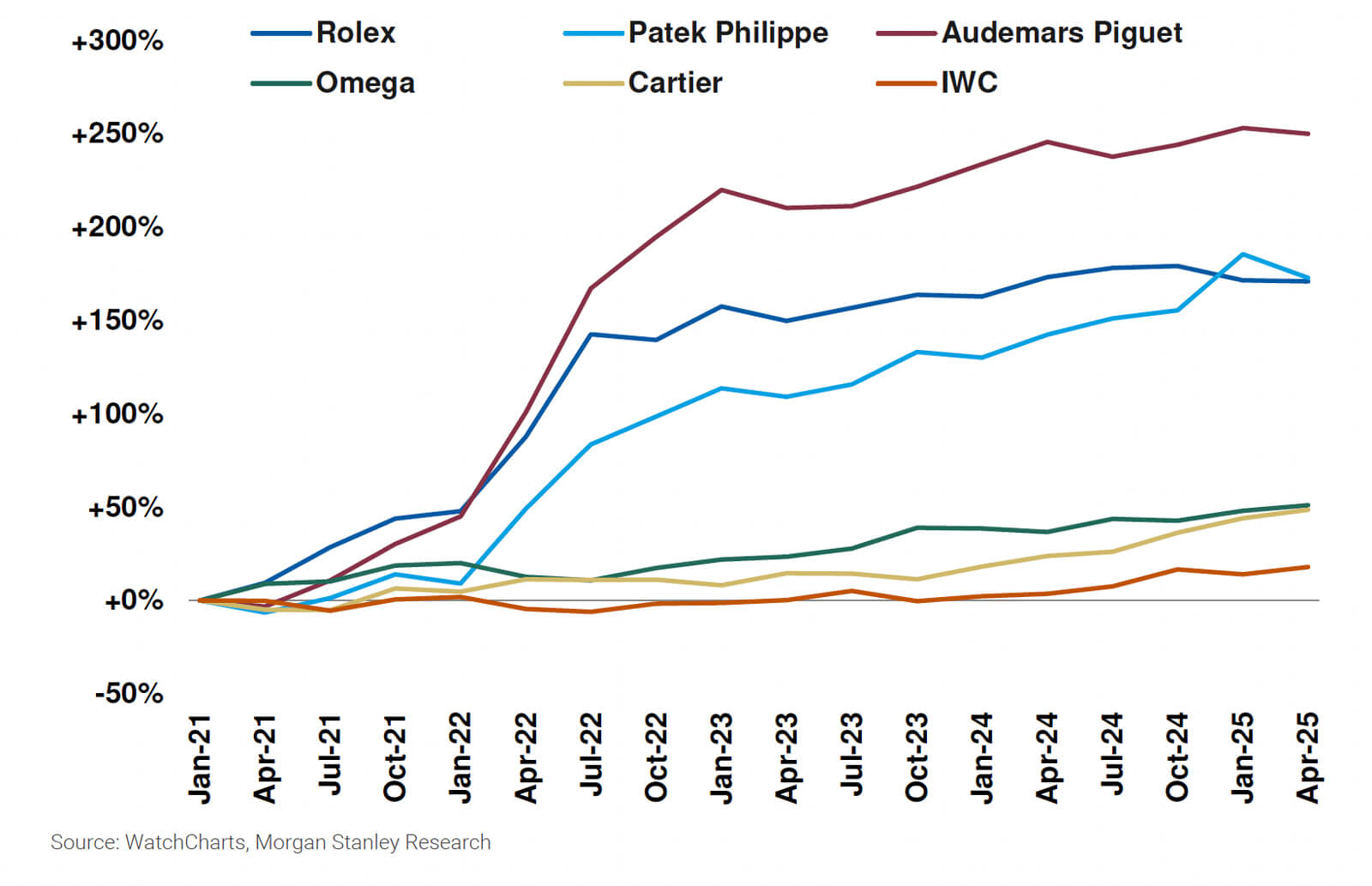

Efficiency of the WatchCharts General Market value tracker and model costs for the Large Three since 2021

Quarterly sequential efficiency of the WatchCharts General Market value tracker since 2022

Until in any other case acknowledged, the evaluation of the general watch market on this report relies on WatchCharts General Market value tracker, which aggregates the secondary market efficiency of 300 watches from 10 main manufacturers, weighted by annual transaction worth. Model or assortment efficiency is analyzed utilizing its respective WatchCharts value tracker derived from the highest 30 watches inside the model or assortment.

Group efficiency relies on the highest 30 watches for every model inside the group, all weighted by annual transaction worth. WatchCharts value tracker could be subsequently revised or adjusted. The newest publications prevail.

The Large Three outperformed after being in the course of the pack in 2024. Rolex (+0.4% QoQ), Audemars Piguet (-0.3% QoQ), and Patek Philippe (-1.5% QoQ) have been among the many greatest performing manufacturers in 1Q25. Of the 35 Swiss manufacturers we monitor, Rolex and AP held the second and third spots by way of QoQ efficiency, whereas Patek Philippe was within the prime 10.

It is a vital distinction from the development in 2024 (the place the Large Three discovered themselves extra in the course of the pack), and 2022/2023 (the start of the market downturn, after they led the decline). Provided that essentially the most fascinating fashions from these manufacturers proceed to commerce above retail, the Large Three have continued to retain robust model fairness regardless of the tumultuous nature of their secondary markets over the previous few years.

Efficiency abstract of Swiss watch manufacturers on the secondary market in 1Q25 (QoQ change)

Efficiency abstract of Swiss watch manufacturers on the secondary market in 1Q25 (YoY change)

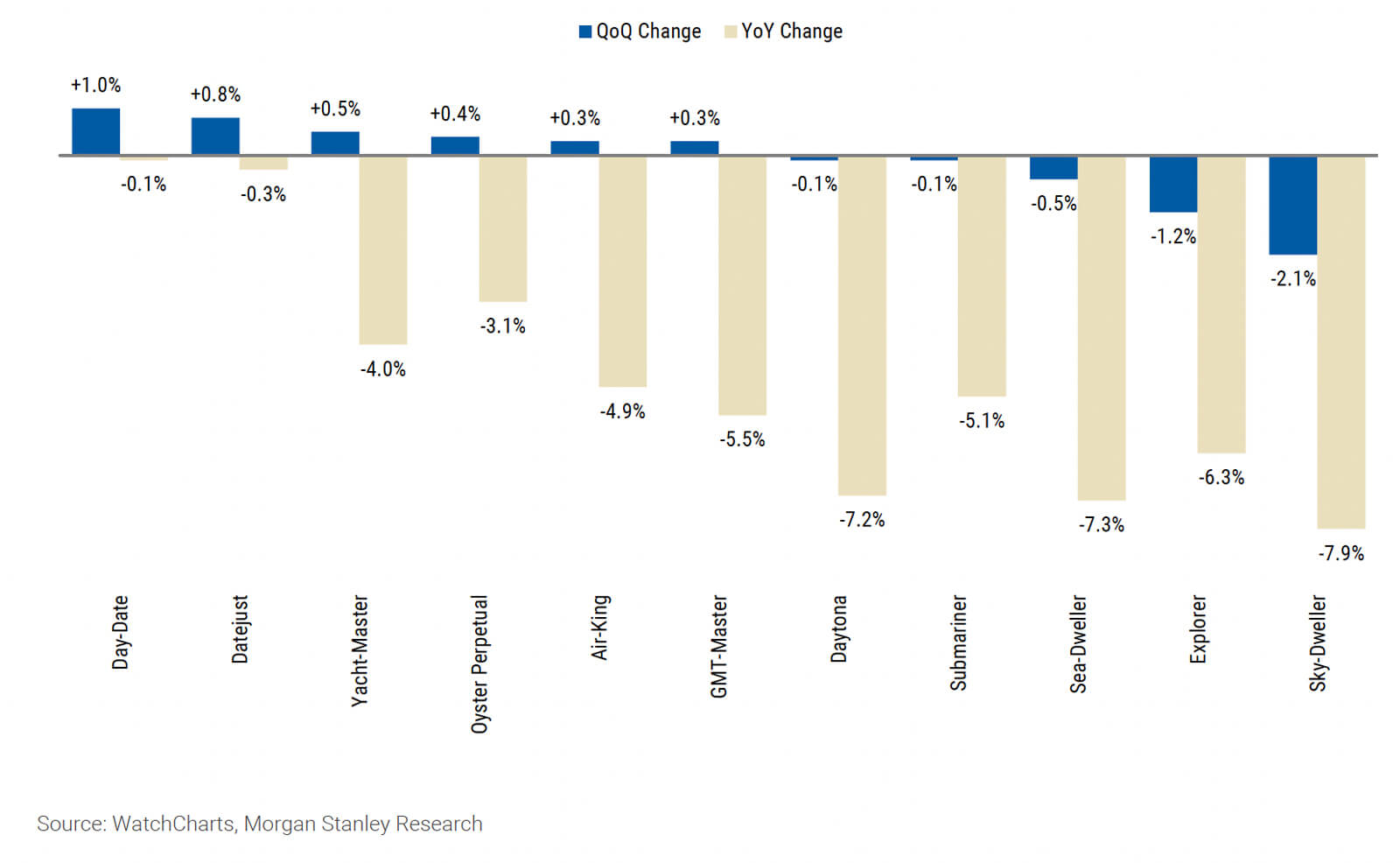

Rolex SA gained +0.3% QoQ as robust efficiency from Rolex (+0.4%) was barely offset by Tudor (-2.0%). Rolex continues to profit from robust demand for its Datejust and Day-Date collections, which noticed secondary costs rise +0.8% and +1.0% QoQ respectively. Many different Rolex collections, together with Yacht-Grasp, Oyster Perpetual, and GMT-Grasp, additionally noticed costs rise by lower than 1%. Whereas a few of this constructive development is probably going seasonal (for instance, on account of anticipation for Watches & Wonders), the power of Rolex’s efficiency throughout each its Traditional and Skilled collections stays distinctive inside the Swiss watch business. Tudor additionally made a slight comeback in 1Q25, putting in the course of the pack after being one of many worst performers of 2024.

1Q25 efficiency of Rolex collections, QoQ and YoY

Swatch Group (-2.5% QoQ) was the highest performer among the many listed teams. Swatch Group’s efficiency continues to be boosted by Omega (-1.0% QoQ), which has one of many strongest secondary markets amongst mid-level manufacturers as a result of iconicity of its Speedmaster and Seamaster collections. Nonetheless, many different Swatch Group manufacturers underperformed. Breguet (-4.0%), Longines (-5.5%) and Blancpain (-5.8%) all misplaced not less than 4% QoQ, whereas Swatch (-8.9%) and Tissot (-11.6%) have been the 2 worst performing manufacturers in 1Q25 amongst these tracked.

The efficiency of Swatch and Tissot can primarily be attributed to the MoonSwatch and PRX collections, which dominate their respective secondary markets. Whereas these collections have been extremely popular and well-received by shoppers, the preliminary pleasure for them has pale by now, a number of years after their launch.

Most Richemont (-2.6% QoQ) manufacturers proceed to steadily decline. The efficiency of Richemont manufacturers stays usually in-line with earlier quarters. Panerai (-1.9%), Jaeger-LeCoultre (-2.2%), Vacheron Constantin (-3.1%), A. Lange & Sohne (-3.1%), and IWC (-3.5%) costs all fell by low single digits QoQ. Cartier (-1.1%) fared a bit higher, rebounding from its 4Q24 underperformance and sustaining its resilient place amongst mid-level manufacturers. Montblanc (+0.5%) had the strongest QoQ efficiency amongst these tracked, though the model has a particularly restricted secondary market presence and thus equally little impression on Richemont’s broader efficiency.

LVMH (-3.2% QoQ) manufacturers are a combined bag. BVLGARI (-0.6%) and Zenith (-0.9%) costs each fell lower than 1% QoQ, however TAG Heuer (-4.1%) and Hublot (-5.2%) fared worse. Particularly, we’re involved concerning the efficiency of Hublot, which ranks among the many manufacturers that noticed the most important secondary value declines over the previous quarter, yr, and two years. Together with the model’s excessive value level (with most fashions retailing within the low-five-figures), poor worth retention (round -60% for fashionable fashions), and controversial popularity, we imagine that Hublot could also be dealing with an uphill battle in sustaining long-term demand.

Efficiency of WatchCharts value tracker for Swiss teams since 2021

Efficiency of WatchCharts value tracker for Swiss teams in 1Q25, QoQ and YoY

Evaluation of market well being and fundamentals

Market well being analysis:

We suggest 4 key indicators for evaluating the well being of the secondary watch market or one in every of its segments: complete provide (the quantity of stock in the marketplace), absorption charge (the speed at which the stock is popping over), age of stock (how outdated the obtainable stock is), and days on market (how briskly offered stock is promoting).

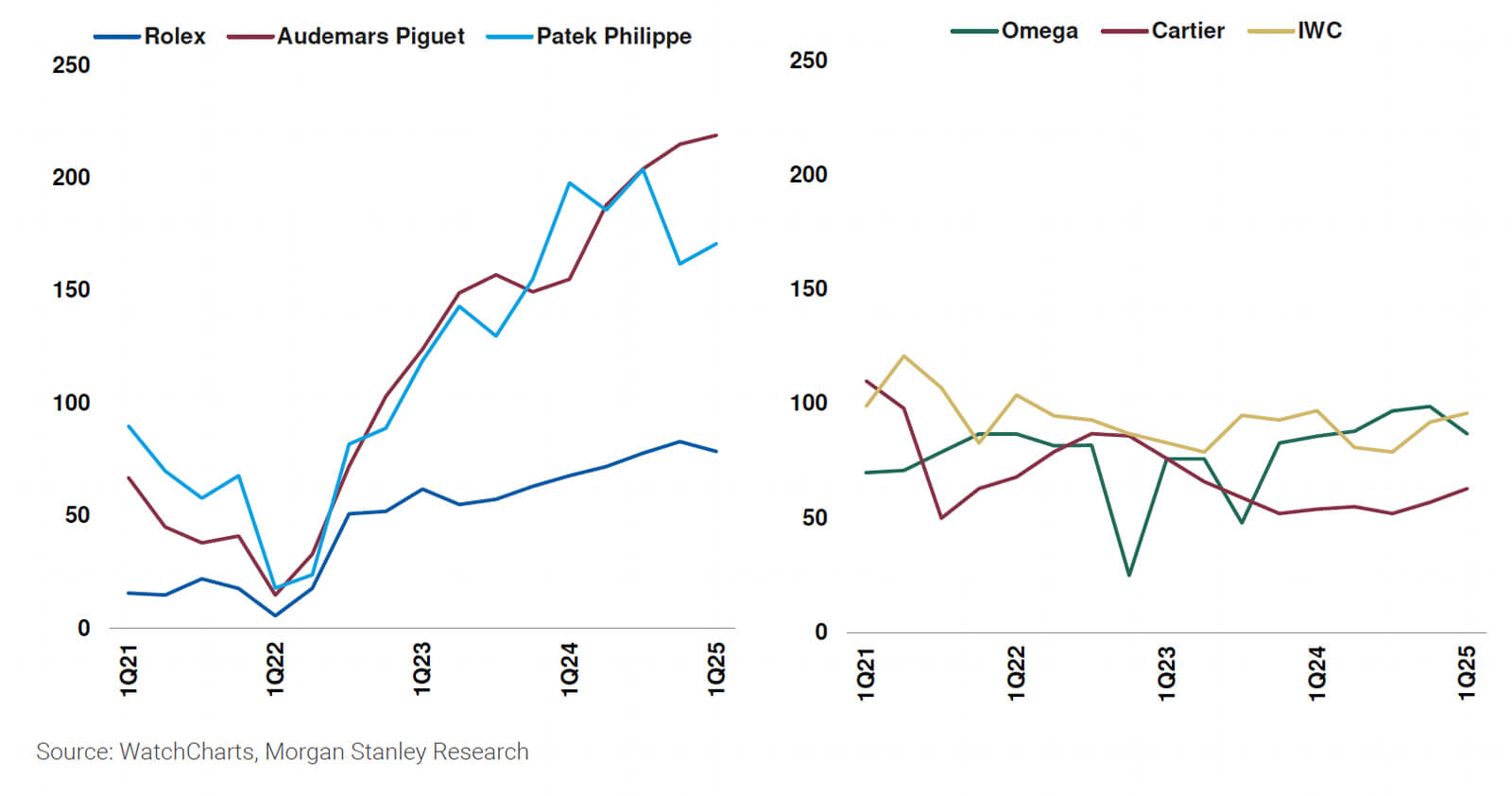

Whole worth of accessible stock on the secondary marketplace for the Large Three and mid-level manufacturers since 2021

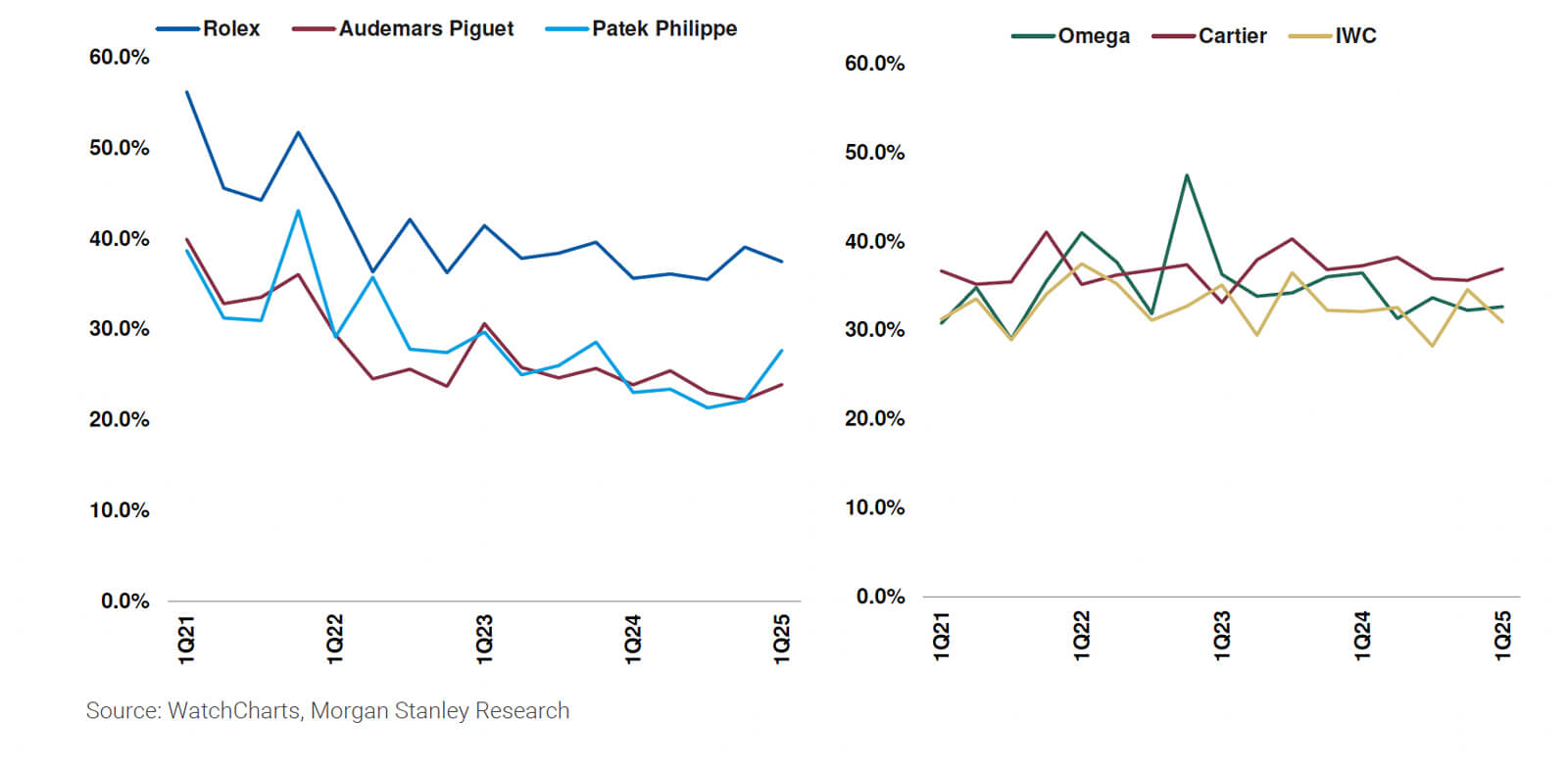

Common quarterly absorption charge (measure of stock turnover, outlined as

offered stock worth divided by complete stock worth over a given interval) for the Large Three and mid-level manufacturers since 2021

Worth-adjusted median age of stock (variety of days for which

bought stock is held by sellers) evolution for the Large Three and mid-level manufacturers since 2021

Common quarterly days on market (median variety of days for which offered

stock was obtainable in the marketplace) evolution for the Large Three and mid-level manufacturers since 2021

Provide and absorption charge enhance for the Large Three… Absorption charge improved or stayed the identical for Rolex (+1.8pp), Patek Philippe (+4.7pp), and Audemars Piguet

(+0.0pp) in 1Q25 in comparison with the year-ago quarter. On the similar time, all three manufacturers additionally noticed a QoQ decline in complete provide, a constructive signal provided that the secondary watch market right now continues to be feeling the consequences of a mass sell-off starting in 2Q22.

Provide ranges for Patek Philippe and Audemars Piguet decreased by -4.4% and -0.9% respectively (after provide for each manufacturers reached all-time highs in 4Q24), whereas Rolex provide ranges fell -0.2%. Encouragingly, the provision degree for Rolex has declined two quarters in a row, and is now the bottom since January 2024.

…although age of stock stays traditionally elevated and days on market stays in-line. This means that there’s nonetheless good liquidity for watches which are priced appropriately out there, in keeping with our normal commentary that model fairness stays robust for the Large Three.

Nonetheless, stale or optimistically priced listings proceed to build up, contributing to the elevated age of stock, as many sellers stay hesitant to appreciate losses. Whereas the provision correction in 1Q25 is a constructive signal, sustained restoration will seemingly rely upon broader vendor capitulation and continued purchaser confidence.

Secondary demand stays robust for a lot of manufacturers from the listed teams, although doubtlessly on the expense of retail gross sales. Regardless of falling secondary costs, now we have seen slight development within the secondary markets of many key manufacturers from the listed teams. Within the instances of the important thing mid-level manufacturers (Omega, Cartier, and IWC), stock ranges have risen persistently whereas absorption charges stay comparatively secure, indicating that shopper demand stays robust (on the proper value).

Nonetheless, as mentioned in our key questions for 2025 in our final report, we’re involved concerning the displacement of retail demand by the secondary market – and see some proof of this when evaluating major and secondary gross sales estimates (see Exhibit 12). Given worsening worth retention (which we focus on extra within the subsequent part) for in-production fashions, and (usually) much more vital reductions within the discontinued/classic markets for many manufacturers, the secondary market right now represents traditionally robust value-for-money for shoppers who’re prepared to cross-shop.

Comparability of YoY transaction worth in FY24 between the retail market

(primarily based on LuxeConsult, main Swiss watch consulting agency, estimates in USD) and secondary market (primarily based on WatchCharts estimates)

Evaluation of worth retention and market efficiency by model

We outline worth retention (VR) because the premium/low cost that an in-production watch trades for on the secondary market relative to its retail value (in USD), a key metric to gauge model desirability.

Worth retention by model (costs as of April 1, 2025)

Worth retention evolution since January 2, 2025 primarily based on all in-production

fashions and LfL fashions solely

Except for Rolex, worth retention for all tracked manufacturers continues to say no. Rolex’s worth retention was comparatively unchanged in comparison with our January 2025 evaluation, with an evolution of -0.2pp (+0.2pp LfL). Tudor additionally carried out comparatively strongly (-0.7pp, -0.9pp LfL) regardless of having the bottom absolute worth retention degree amongst tracked manufacturers. All different manufacturers noticed a sequential lower in worth retention of not less than -2pp, throughout all in-production fashions and LfL fashions solely.

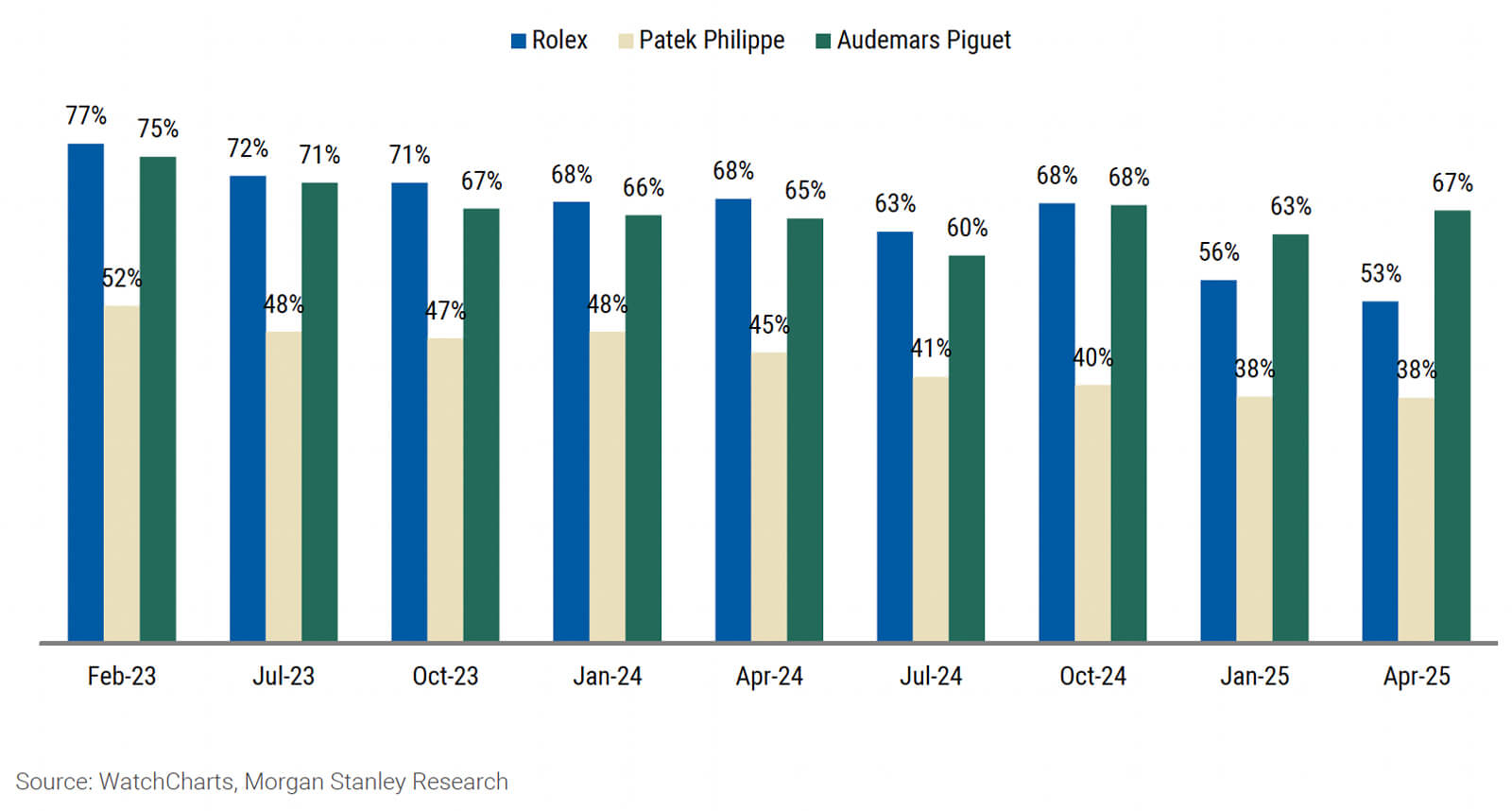

Rolex additionally changed Patek Philippe because the model with the very best worth retention. Since we first launched complete worth retention evaluation in February 2023, Patek Philippe has persistently held the highest spot by way of absolutely the worth retention degree. Nonetheless, the hole between Patek Philippe and Rolex (which has ranked second since mid-2023) has been steadily shrinking over the previous two years.

In 1Q25, Patek Philippe noticed the most important sequential decline in worth retention amongst tracked manufacturers, each throughout all in-production fashions (-6.7pp) and LfL fashions solely (-3.4pp). Rolex now holds the highest spot by way of absolute worth retention degree, though the fashions from Patek Philippe that do commerce above retail proceed to command by far the very best premiums (see Exhibit 16 for this breakdown).

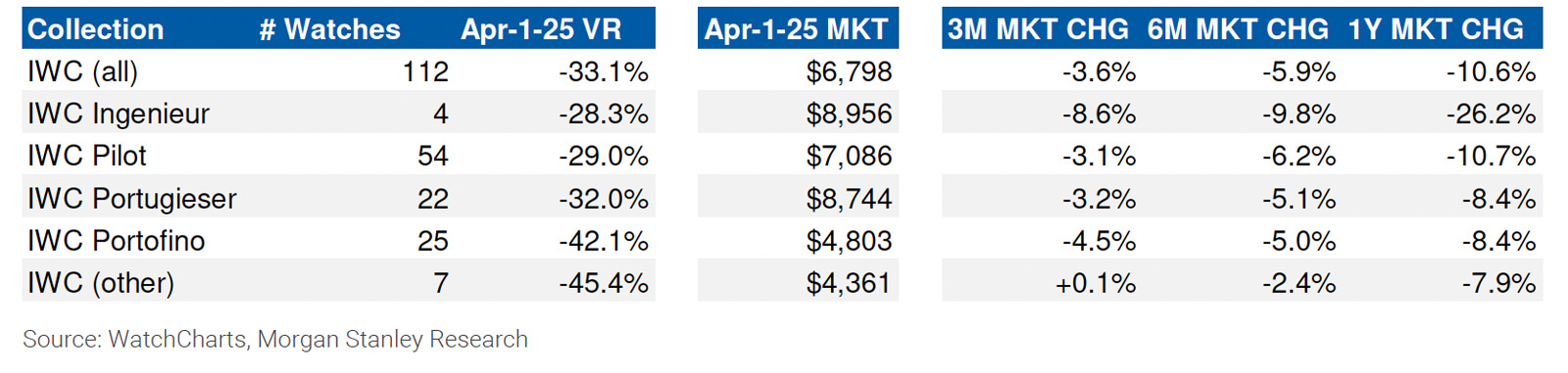

IWC rolls out extra retail value adjustments. In our January 2025 report, we mentioned how IWC had lowered retail costs for a good portion of its catalog. Since then, now we have tracked much more adjustments to IWC’s retail costs, with value decreases rolling out to extra fashions, in addition to a small variety of value will increase.

Amongst affected fashions, the typical retail value change was -3%, leading to a -1% lower in retail costs general. See the part on IWC beneath for extra particulars. We didn’t observe retail value adjustments for every other model.

The Large Three proceed to commerce above retail… Rolex, Patek Philippe, and Audemars Piguet have worth retention ranges starting from +5% to +15% above retail. Nonetheless, the character of their worth retention performances differs fairly considerably. Rolex has essentially the most variety of watches which commerce above retail (69/131 fashions tracked), coming from all kinds of mannequin strains. In the meantime, Patek Philippe has the fewest fashions that commerce above retail, however they command the very best secondary market premiums. Lastly, Audemars Piguet has the best proportion of fashions that commerce above retail (67%), however they arrive virtually solely from the Royal Oak assortment.

…whereas each different model has a secondary market low cost of not less than -28%. Exterior of the Large Three, Cartier noticed the most important lower in worth retention (-6.1pp, although solely -3.0pp LfL). A. Lange & Sohne and Vacheron Constantin additionally misplaced greater than 3pp on a LfL foundation. With Cartier’s decline, the hole in worth retention between the Large Three and different tracked manufacturers has reached greater than 34pp (+5.3% from third-ranked Audemars Piguet, versus -28.8% from fourth-ranked Cartier). Whereas robust VR shouldn’t be a requirement for driving model desirability (significantly for manufacturers positioned at entry or mid-level value factors, the place absolutely the depreciation is decrease), we imagine that this disparity captures a continued shopper desire for the Large Three.

Evolution of the share of in-production Rolex, Patek Philippe, and Audemars Piguet fashions that commerce above retail since February 2023

Comparability of the variety of in-production fashions buying and selling above retail from Rolex, Patek Philippe, and Audemars Piguet as of April 2025, and their worth retention ranges

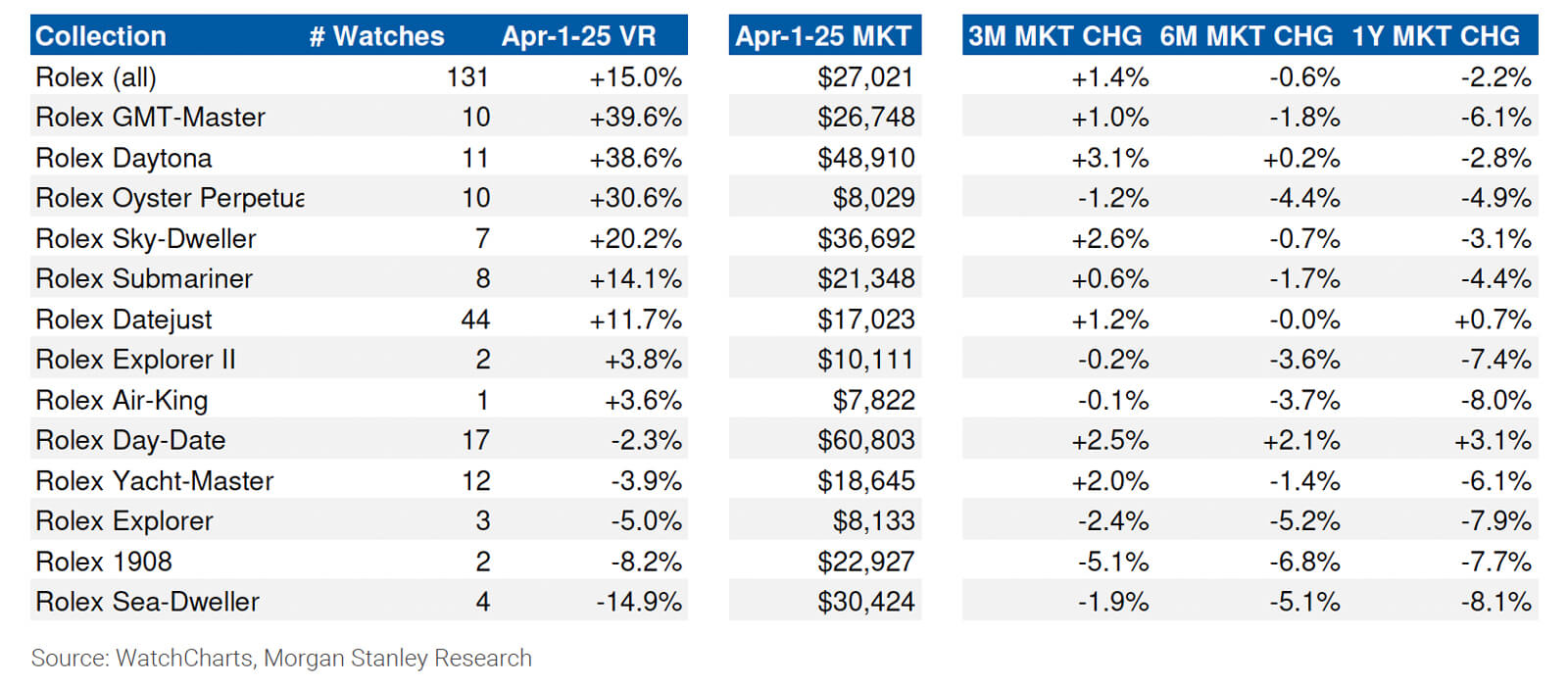

Rolex

In manufacturing Rolex fashions commerce for a median of +15.0% above retail, in comparison with +15.2% as of January 2025 (-0.2pp, +0.2pp LfL), primarily based on our evaluation of 131 fashions. We didn’t observe any adjustments to Rolex retail costs within the US for the reason that model elevated costs by a median of 4.5% initially of this yr.

The state of our newest evaluation displays a set of product discontinuations, which passed off initially of April 2025, coinciding with the model’s new releases on the Watches & Wonders commerce present. Consequently, the variety of fashions included in our evaluation decreased from 146 in January 2025 to 131 right now.

The entire discontinued fashions which left our evaluation have been from the Oyster Perpetual assortment, together with the extremely fascinating “celebration dial” variants in 41mm, 36mm, and 31mm case sizes. General, these product discontinuations had a barely unfavourable impact on the model’s general worth retention. Any newly introduced fashions, together with these from the brand new Land-Dweller assortment, usually are not included in our evaluation as they’ve but to enter the secondary market as of the time of writing.

Other than product discontinuations, the state of Rolex worth retention stays comparatively in-line with our earlier report. We noticed a slight enhance in market costs for a number of fascinating collections, together with the GMT-Grasp and Daytona. Nonetheless, costs proceed to melt for collections which commerce beneath retail, together with the Explorer, 1908, and Sea-Dweller. Immediately, 53% of tracked Rolex fashions command secondary market premiums, in comparison with 56% 1 / 4 in the past and 68% a yr in the past.

Rolex worth retention evaluation by assortment

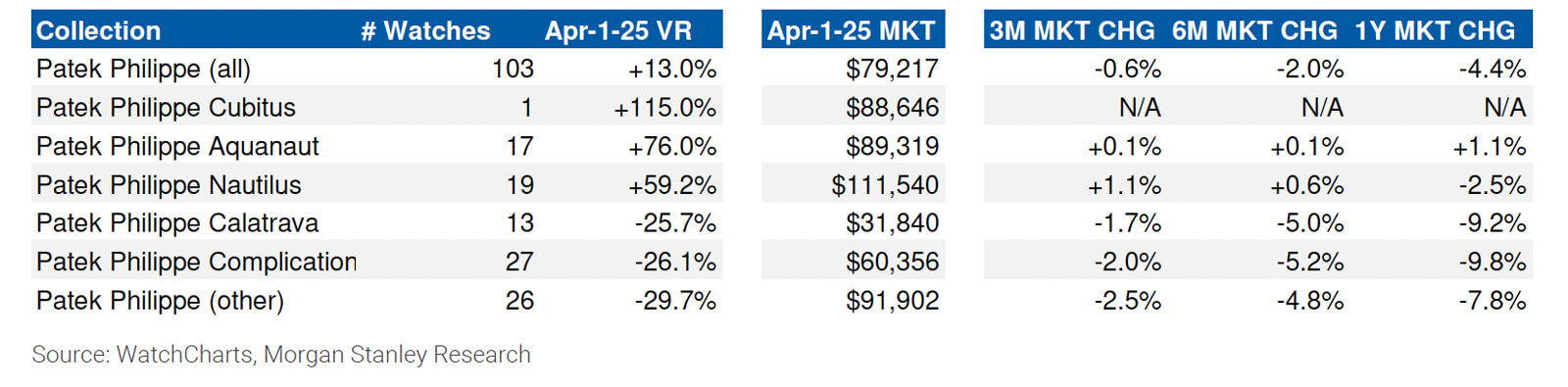

Patek Philippe

In-production Patek Philippe fashions commerce for a median of +13.0% above retail, in comparison with +19.7% in January 2025 (-6.7pp, -3.4pp LfL). 5 new Patek Philippe fashions have entered the secondary market since our earlier report, whereas 9 left our evaluation on account of product discontinuations in February. Curiously, Patek Philippe didn’t enhance US retail costs in 1Q25, as they did within the first quarter of 2024 and 2023.

Patek Philippe noticed the most important sequential lower in worth retention among the many 9 manufacturers we monitor. That is the results of three components: a -0.6% lower in secondary market costs, a rise in proportional gross sales from below-retail fashions, and the discontinuation of a number of significantly fascinating fashions from the Nautilus and Aquanaut collections. Particularly, the discontinuation of the Nautilus 5712/1A and Aquanaut 5167/1A had the most important impression on worth retention, with each fashions beforehand buying and selling at almost double retail.

Immediately, each mannequin from Patek Philippe’s sports activities watch collections (Nautilus, Aquanaut, and Cubitus) continues to commerce above retail, whereas solely a handful of fashions outdoors these collections command secondary market premiums. Notably, our VR evaluation now consists of the stainless-steel Cubitus 5821/1A, which we estimate trades for greater than double retail on the secondary market.

Patek Philippe worth retention evaluation by assortment

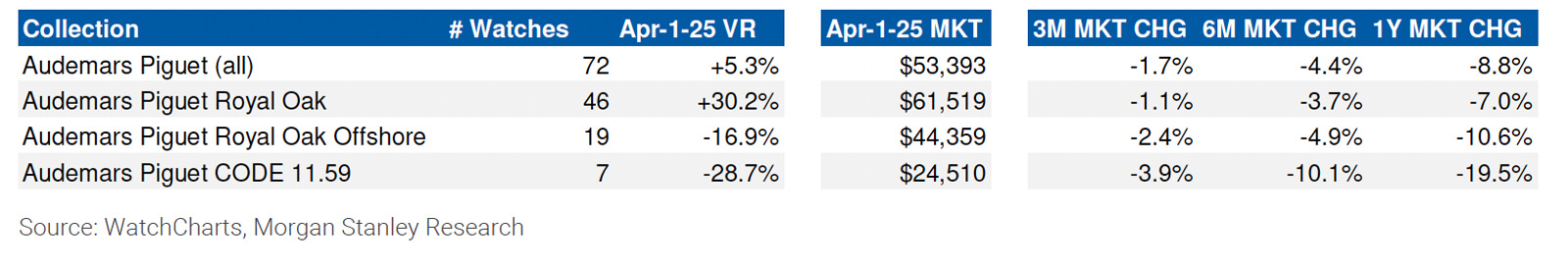

Audemars Piguet

In-production Audemars Piguet fashions commerce for a median of +5.3% above retail, in comparison with +7.8% in January 2025 (-2.5pp, -2.8pp LfL). We didn’t observe any US retail value adjustments for the model since our final report.

Much like Rolex and Patek Philippe, Audemars Piguet additionally discontinued fairly just a few fashions in 1Q25, bringing down the variety of fashions in our evaluation from 79 to 72. Among the many discontinuations have been a number of fascinating Royal Oak openworked fashions, in addition to a half-dozen CODE 11.59 fashions which beforehand ranked as among the model’s worst performers by worth retention. Consequently, the CODE 11.59 assortment’s worth retention noticed a sequential enchancment from -33.5% in January to -28.7% right now.

The Royal Oak assortment continues to command a big secondary market premium, buying and selling for greater than +30% above retail on common. Its value efficiency has additionally been the perfect amongst AP collections over the previous yr, at -7.0% in comparison with -10.6% for the Royal Oak Offshore and -19.5% for the CODE 11.59. Nonetheless, the model’s general worth retention is now approaching low single digits.

Audemars Piguet worth retention evaluation by assortment

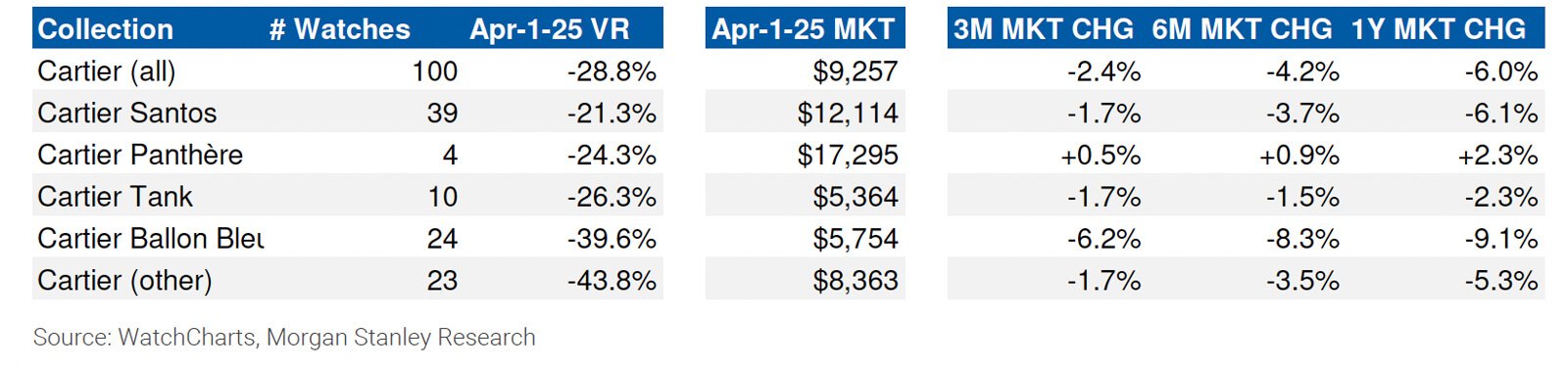

Cartier

In-production Cartier fashions commerce for a median of -28.8% beneath retail, in comparison with -22.7% in January 2025 (-6.1pp, -3.0pp LfL). We didn’t observe any US retail value adjustments for the model since our final report.

Cartier stays the model with the strongest worth retention outdoors of the Large Three, although its place has slipped a bit on account of a 2.4% common lower in costs of in-production fashions, and the discontinuation of many fashions from the model’s prime collections (Santos, Tank, and Panthere). We estimate that just one Cartier mannequin presently trades above retail – the Santos-Dumont WSSA0046.

Cartier worth retention evaluation by assortment

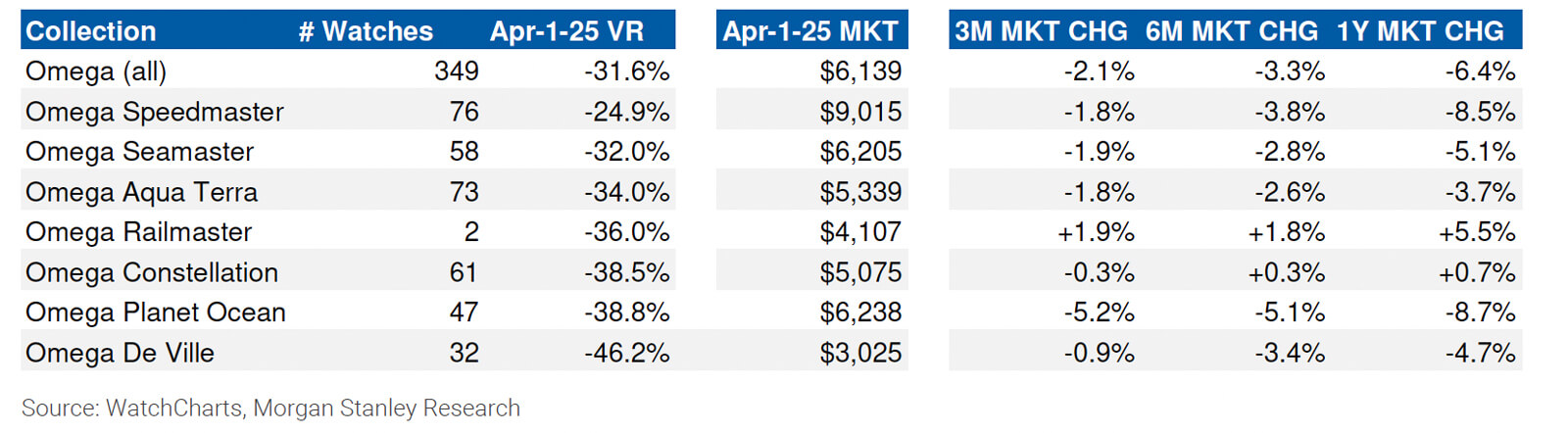

Omega

In-production Omega fashions commerce for a median of -31.6% beneath retail, in comparison with -29.4% in January 2025 (-2.2pp, -2.3pp LfL). We didn’t observe any US retail value adjustments for the model since our final report.

The variety of Omega fashions included in our evaluation has elevated considerably since our final report, although that is primarily the results of inconsistencies surrounding the discontinuation standing of sure fashions (which we decide from the model’s web site), relatively than the results of many new fashions getting into the secondary market. Nonetheless, the top-line observations stay fairly in keeping with previous reviews. The Speedmaster stays Omega’s greatest performing and hottest assortment, with two fashions persevering with to commerce above retail.

Omega worth retention evaluation by assortment

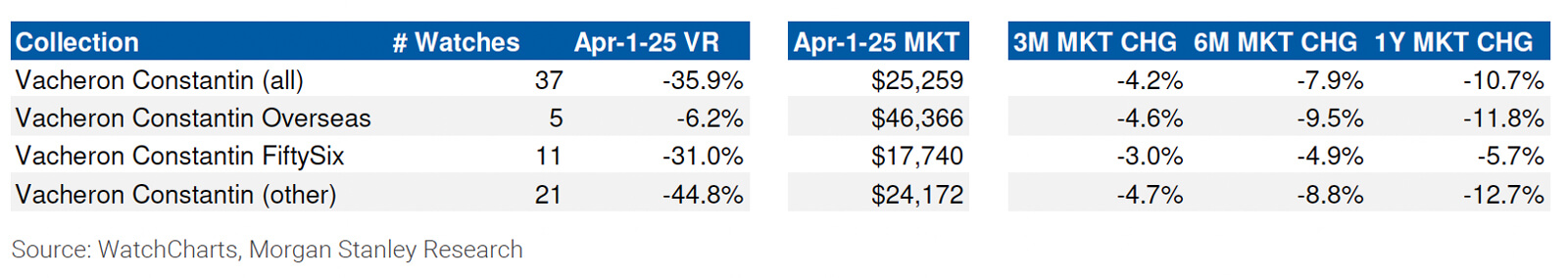

Vacheron Constantin

In-production Vacheron Constantin fashions commerce for a median of -35.9% beneath retail, in comparison with -33.6% in January 2025 (-2.3pp, -3.3pp LfL). We didn’t observe any US retail value adjustments for the model since our final report.

Vacheron Constantin continues to battle, posting the worst secondary market efficiency of in-production fashions for the second quarter in a row (-4.2%). The Abroad continues to carry its worth the perfect, with the one Vacheron Constantin mannequin that trades above retail coming from the gathering (ref. 4520V/210A-B128 with a blue dial). Nonetheless, its uplifting impact on the model general stays restricted because of low transaction quantity; regardless of it now being greater than a yr for the reason that assortment was refreshed, the earlier 4500V technology Abroad fashions are nonetheless traded far more steadily.

Vacheron Constantin worth retention evaluation by assortment

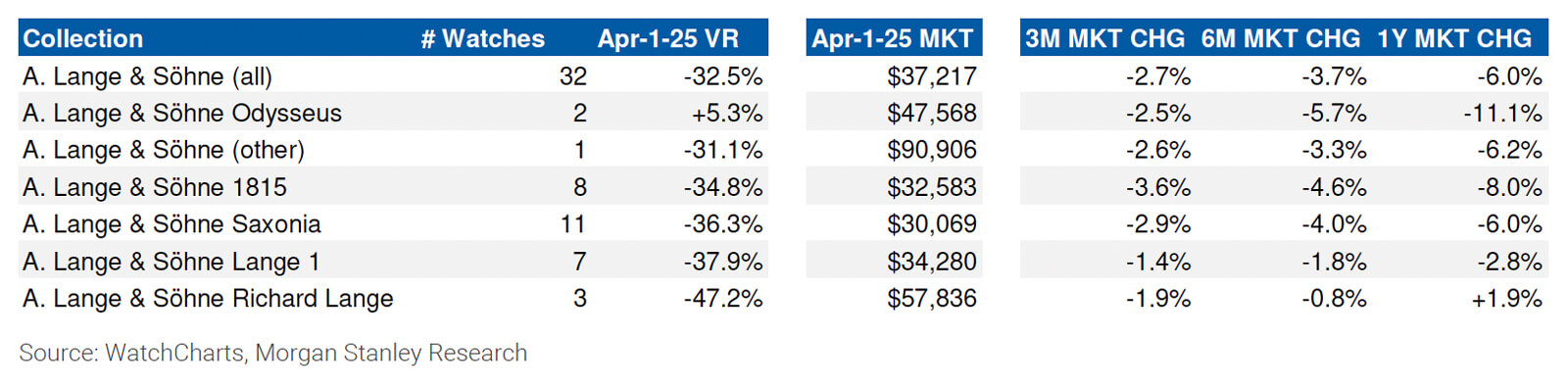

A. Lange & Sohne

In-production A. Lange & Sohne fashions commerce for a median of -32.5% beneath retail, in comparison with -28.7% in January 2025 (-3.8pp, -3.1pp LfL). We didn’t observe any US retail value adjustments for the model since our final report. Worth retention dynamics for Lange stay in-line with historic traits, with the Odysseus persevering with to commerce above retail whereas all different collections commerce at reductions of not less than -30%.

A. Lange & Sohne worth retention evaluation by assortment

IWC

In-production IWC fashions commerce for a median of -33.1% beneath retail, in comparison with -31.0% in January 2025 (-2.1pp, -2.6pp LfL). After decreasing retail costs for a couple of third of its catalog in 4Q24, IWC adopted up in 1Q25 with extra retail value adjustments. Among the many 112 watches included in our evaluation, 27 noticed retail value decreases (by a median of -4%), whereas 6 noticed retail value will increase (by a median of +4%). On common throughout the complete catalog, retail costs have been lowered by 1%.

Nonetheless, this discount in retail costs was not sufficient to offset a -3.6% decline in common secondary costs final quarter. The Ingenieur assortment specifically, which traded at or barely beneath retail a yr in the past, has seen costs fall 8.6% prior to now quarter and 26.2% prior to now yr. Whereas it nonetheless retains its worth the perfect out of all IWC collections, it does so solely marginally higher than the Pilot assortment, indicating that the hype from the Ingenieur relaunch in 2023 has now largely subsided.

IWC worth retention evaluation by assortment

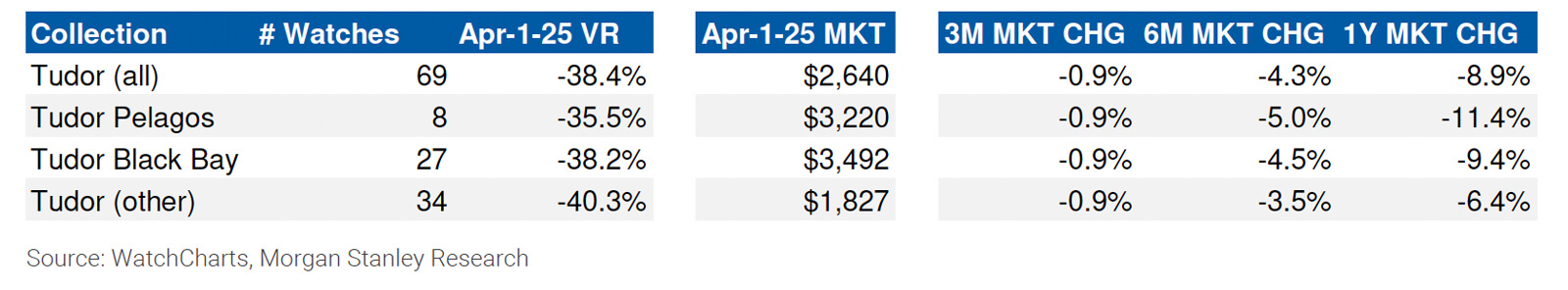

Tudor

In-production Tudor fashions commerce for a median of -38.4% beneath retail, in comparison with -37.7% in January 2025 (-0.7pp, -0.9pp LfL). We didn’t observe any US retail value adjustments for the model since our final report.

Tudor’s efficiency stays largely in-line with our earlier evaluation, with secondary costs falling by about -1% final quarter throughout all of its collections. The Pelagos assortment continues to carry its worth higher than the Black Bay. The highest performing Tudor mannequin by worth retention is the Black Bay Chrono 79360B at -14%.

Tudor worth retention evaluation by assortment

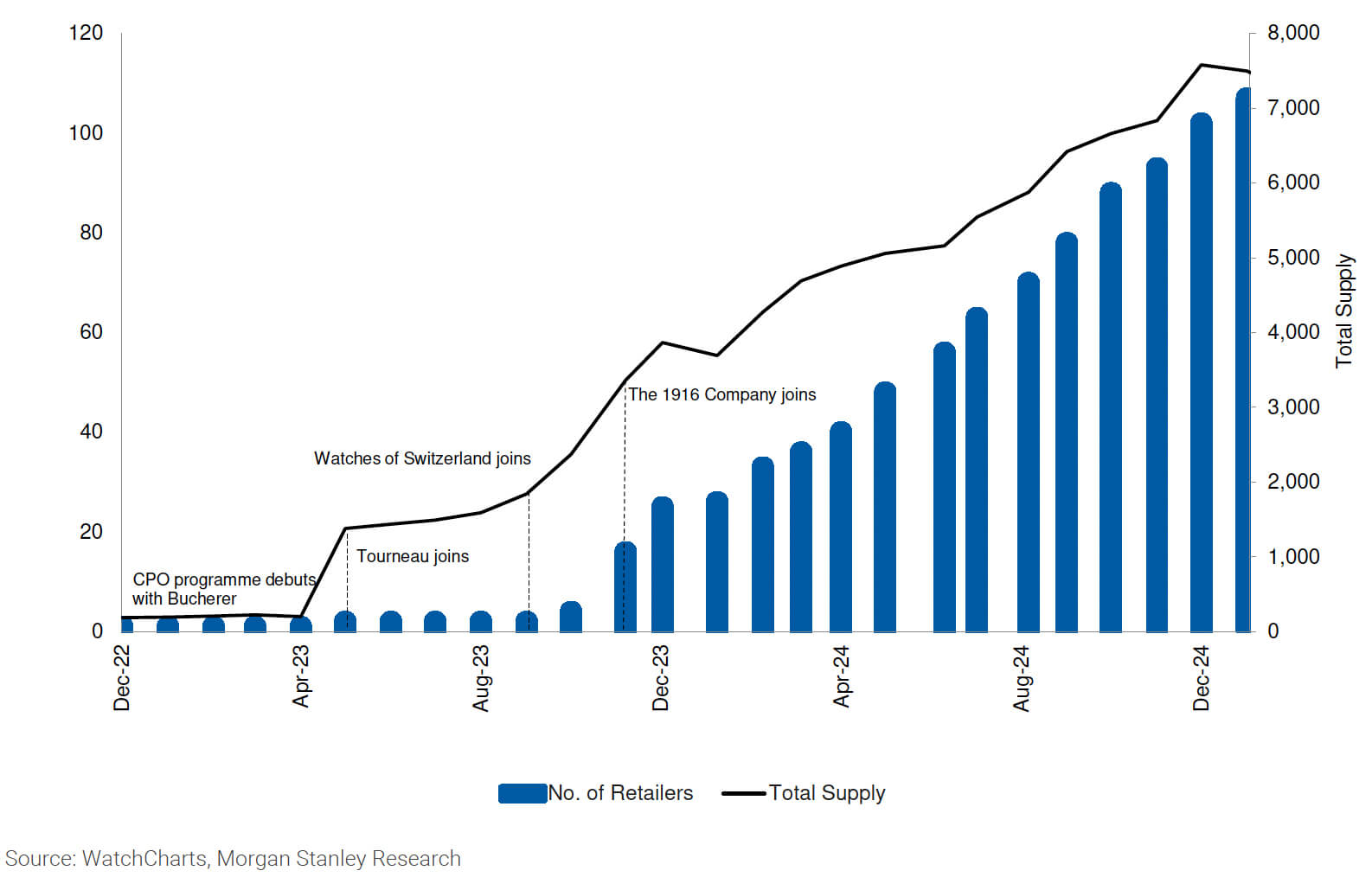

Replace on Rolex Licensed Pre-Owned Program

In December 2022, Rolex launched its Licensed Pre-Owned (CPO) Program, the primary large-scale CPO program by a luxurious watch model. By leveraging WatchCharts information, we monitor the worldwide state of RCPO stock and calculate a “CPO Premium” for every retailer which permits us to evaluate how disruptive the Rolex CPO program is to conventional secondhand watch buying and selling platforms.

The CPO Premium is an estimate for a way far more costly a watch is when listed by a Rolex CPO retailer in comparison with a standard secondary supplier.

The Rolex CPO program continues to develop at a gentle charge. From January 2024 to January 2025, we estimate that the variety of retailers enrolled in this system elevated by greater than 300% – from round 25 retailers a yr in the past to 107 right now. Collectively, these retailers function 217 doorways worldwide that promote CPO watches.

The enlargement of the Rolex CPO program has stalled. In our final report, we estimated that the variety of retailers enrolled within the Rolex CPO program elevated from round 25 in January 2024 to 107 by January 2025, with regular quarter-by-quarter development.

Nonetheless, we’re shocked to report that now we have not seen any new retailers be part of this system for the reason that begin of this yr. In truth, the whole variety of Rolex CPO retailers has decreased barely on account of a number of retailers leaving this system.

We estimate that there are 104 Rolex retailers working RCPO packages right now, with 214 doorways worldwide promoting RCPO watches. Collectively, these retailers maintain round 7,500 watches in stock, with a complete worth of round $170 million (comparatively in keeping with our estimates of seven,500 watches price $160 million in January 2025). We estimate 1Q25 CPO gross sales to be round $100 million, up 15% in comparison with 4Q24.

Evolution of complete provide of Rolex CPO stock and quantity CPO retailers

for the reason that program’s inception in December 2022

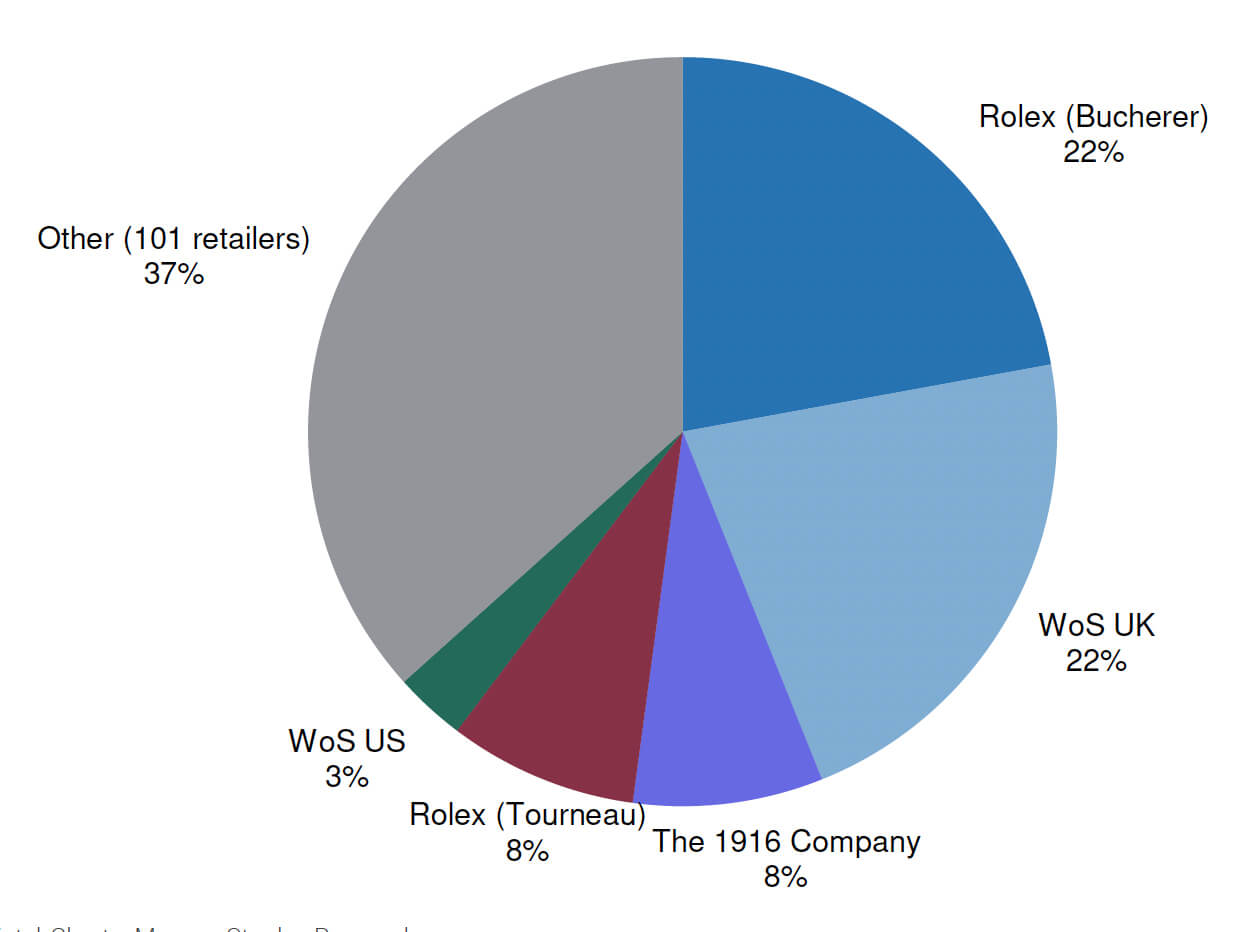

Nearly all of stock continues to be held by just a few key retailers: Rolex (via Bucherer in Europe and Tourneau within the US) and Watches of Switzerland (within the US and UK) every carry round 2,000 Rolex CPO watches in stock, whereas The 1916 Firm within the US shares greater than 600 RCPO watches. Collectively, these three corporations account for round 60% of all world Rolex CPO stock, whereas no different retailer carries quite a lot of hundred items in stock.

Stock distribution by quantity between Bucherer, Tourneau, Watches of

Switzerland US, Watches of Switzerland UK, The 1916 Firm, and different retailers

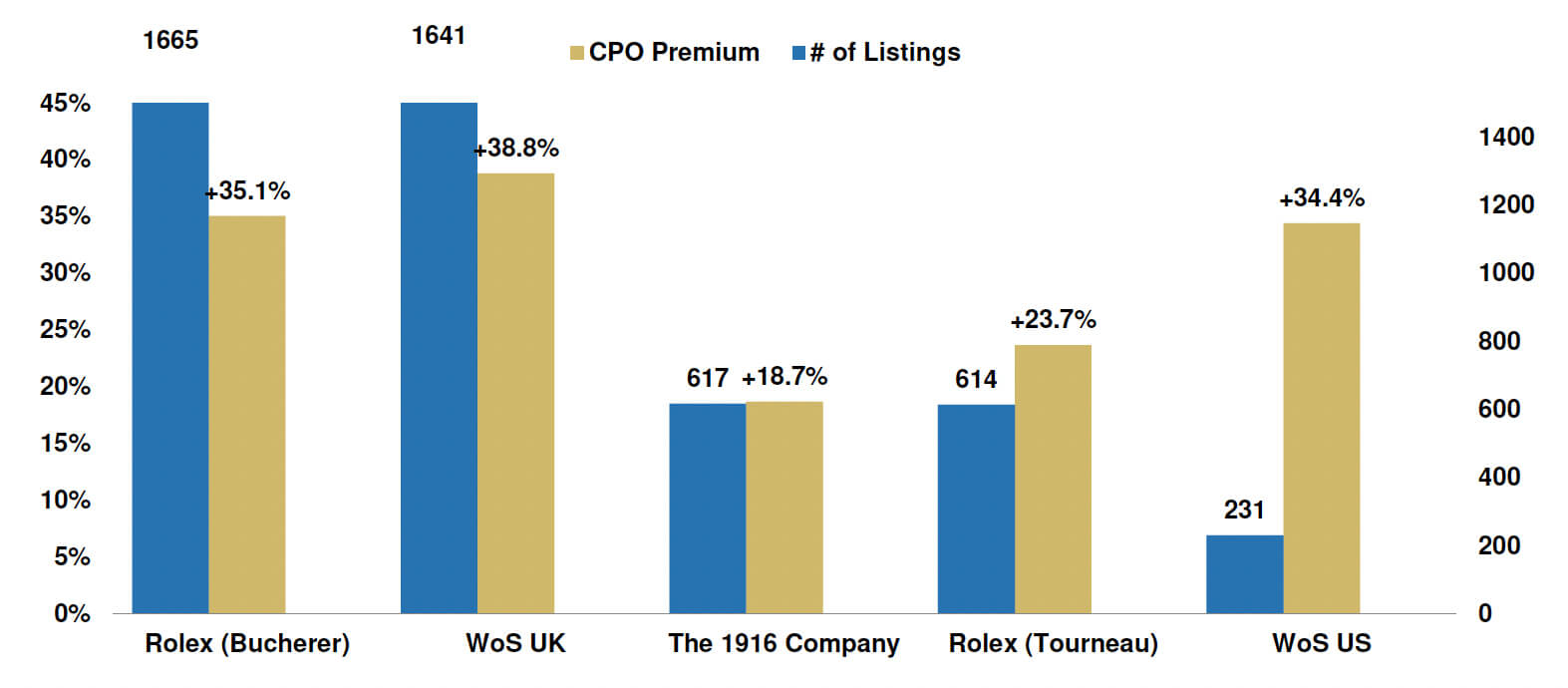

Evaluation of listings and CPO premium for key Rolex CPO retailers

By leveraging WatchCharts information, we calculate a “CPO Premium” for every retailer which permits us to evaluate how disruptive the Rolex CPO program is to conventional secondhand watch buying and selling platforms. The CPO Premium is an estimate for a way far more costly a watch is when listed by a Rolex CPO retailer in comparison with a non-Rolex CPO supplier. The methodology for figuring out the CPO Premium is printed on the finish within the Methodology part.

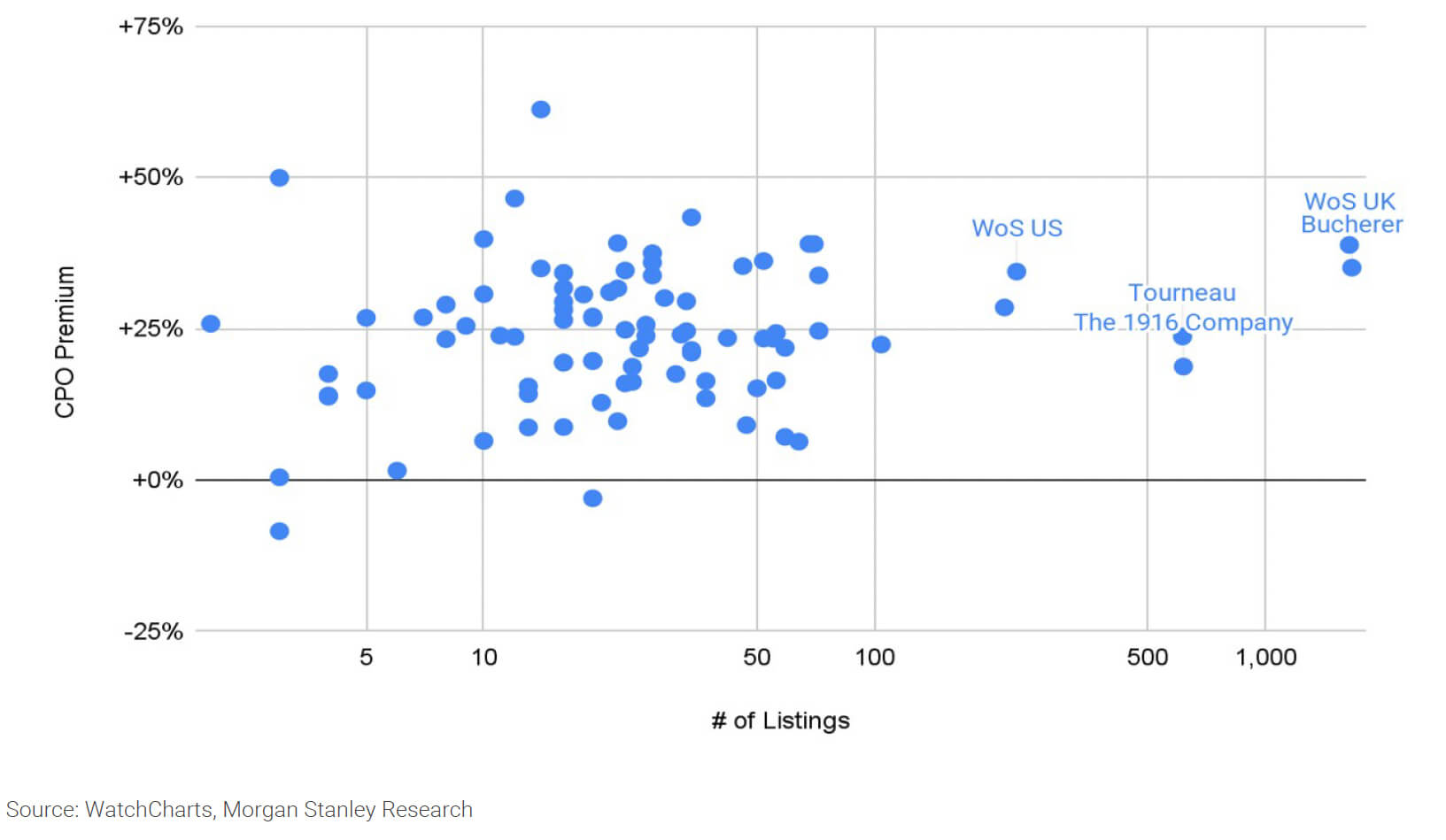

Rolex CPO watches proceed to value round 30% greater than equal non-CPO watches. The median CPO premium throughout all Rolex CPO listings globally is +30.2%. 75% of listings have a CPO premium of +18.8% or extra, whereas 25% of listings have a CPO premium of +41.6% or extra.

Among the many key retailers, The 1916 Firm continues to cost RCPO essentially the most competitively (with a CPO premium of +18.7%) whereas Watches of Switzerland within the UK is the most costly (with a CPO premium of +38.8%).

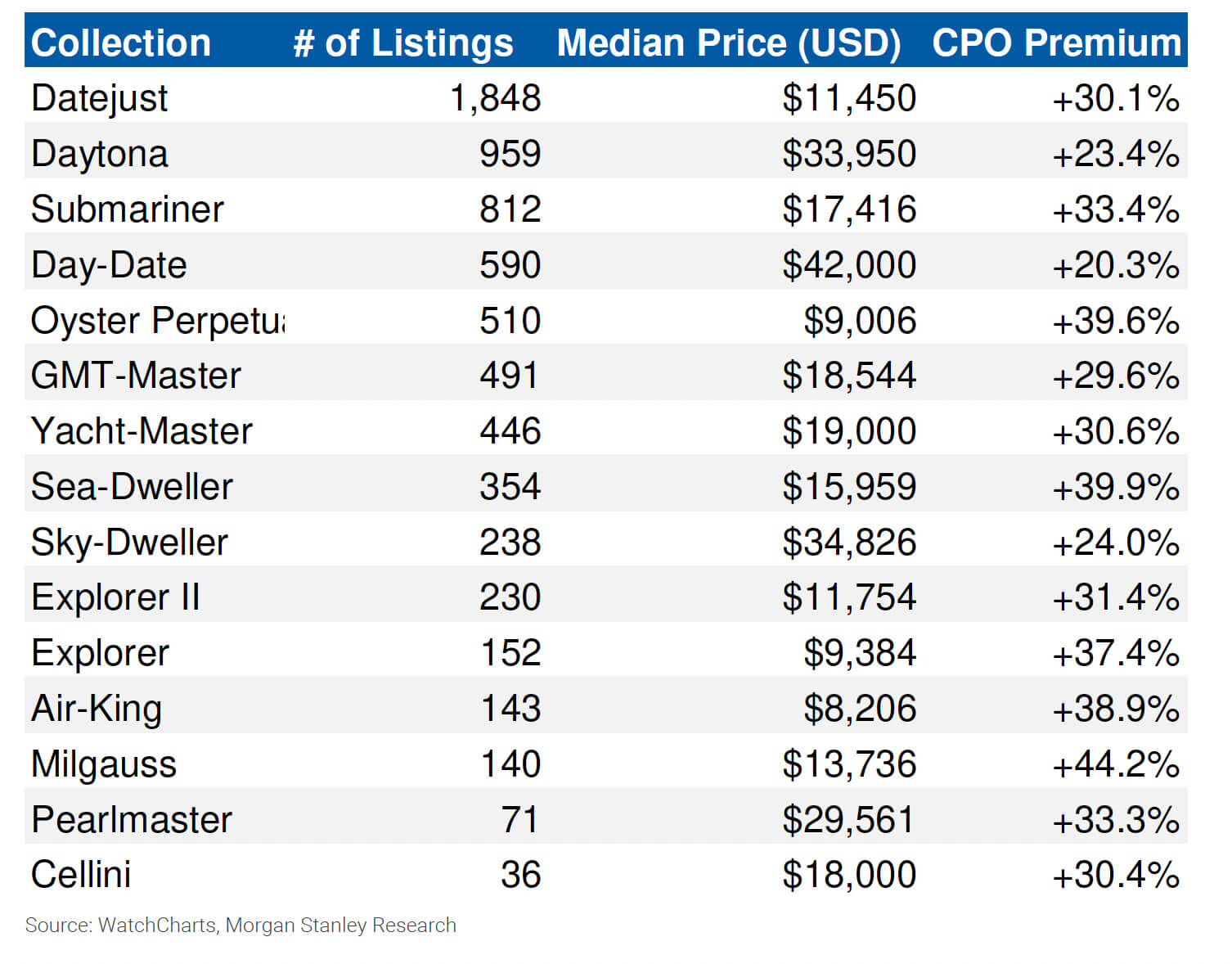

The Datejust, Daytona, and Submariner are the most well-liked Rolex CPO collections. The worldwide state of Rolex CPO stock represents a well-balanced mixture of each Traditional and Skilled fashions. The Datejust is the most well-liked assortment, accounting for round one-quarter of all RCPO watches.

CPO premiums stay comparatively constant throughout collections, although premiums are usually smaller for costlier collections. For instance, the three costliest collections – Day-Date, Sky-Dweller, and Daytona – all characteristic below-average CPO premiums.

Abstract of stock degree and CPO premium for key Rolex CPO retailers as

of April 6, 2025

CPO premium and stock ranges throughout all tracked retailers as of April 6,

2025

Breakdown of world RCPO stock by assortment as of April 6, 2025

Methodology

Worth Retention:

The checklist of current-production fashions for the model primarily based on information from their official web site is recognized, together with the retail value of those watches in USD (watches for which the US retail value shouldn’t be obtainable, shouldn’t be thought-about for inclusion within the evaluation). Then this checklist is cross-referenced with WatchCharts’ catalog of secondary market costs, filtering out any fashions that do not need adequate secondary market information.

Worth retention is then decided utilizing a weighting issue primarily based on WatchChart’s estimates of annual gross sales quantity for every mannequin (primarily based off of gross sales quantity).

For LFL evaluation, frequent fashions between two completely different worth retention information units (two completely different time limits) are decided and delta of the worth retention between these frequent fashions represents the LFL VR evolution.

Rolex CPO Premium:

The Rolex CPO premium is the comparability of two values: the worth of CPO stock (which is understood by indexing the retailer’s web site) and the worth of comparable stock offered by non-CPO sellers (which we have to estimate).

You may obtain the complete report at https://quillandpad.com/wp-content/uploads/2025/04/WatchChartsMS-1Q25-Watch-Market-Report.pdf

You may take a look at WatchCharts Market Updates at https://watchcharts.com/articles/class/dispatch and there are extra market insights and evaluation on their YouTube channel at www.youtube.com/watchcharts

You may also get pleasure from:

WatchCharts March 2025 Secondary Watch Market Replace: Omega Seamasters and Rolex Daytonas and Air-Kings Barely Up, Patek Nonetheless Down

WatchCharts December and Full Yr 2024 Watch Market Replace

So, You Wish to Purchase a Rolex? Nicely, Daddy-O, I’m right here to Discuss you Out of It!

10 Inexpensive Alternate options to Iconic Watches together with the Rolex Submariner and Omega Moonwatch: The Light-weight Heavyweights!

3 Pack Screen Protector Film, compatible with Rado R12.413.803 TPU Guard for Smart watch Smartwatch ( Not Tempered Glass Protectors )